Metal DAO (MTL) is a crypto token that powers Metal Pay and Metal L2, offering real fee discounts and stablecoin governance. Unlike most tokens, it's built for compliance and everyday use-not just speculation.

Crypto Insights from November 2025: Airdrops, Taxes, Exchanges, and Rug Pulls

When you're trying to make sense of crypto airdrop, a free distribution of tokens to wallet holders, often tied to platform engagement or events. Also known as token giveaway, it's one of the most common ways new projects attract users—but also one of the most flooded with scams. In November 2025, we saw real airdrops like WMX and VDR actually deliver value, while others like Bird Finance and Elemon turned into ghost stories. The difference? Transparency, verified partners like CoinMarketCap, and clear rules. Most failed airdrops had no trading volume, no team, and no follow-up. If it sounds too easy, it probably is.

crypto tax, the legal obligation to report gains, rewards, and trades to tax authorities. Also known as crypto income reporting, it’s no longer optional—especially in places like India and the US. India hit hard with a flat 30% tax on Virtual Digital Assets and no loss offsets. In the US, yield farming rewards became taxable income the moment they hit your wallet. If you didn’t track your DeFi transactions, you’re already behind. These rules aren’t changing—they’re getting stricter. The posts this month didn’t just warn you—they showed you exactly what to log, how to calculate it, and where to find the tools.

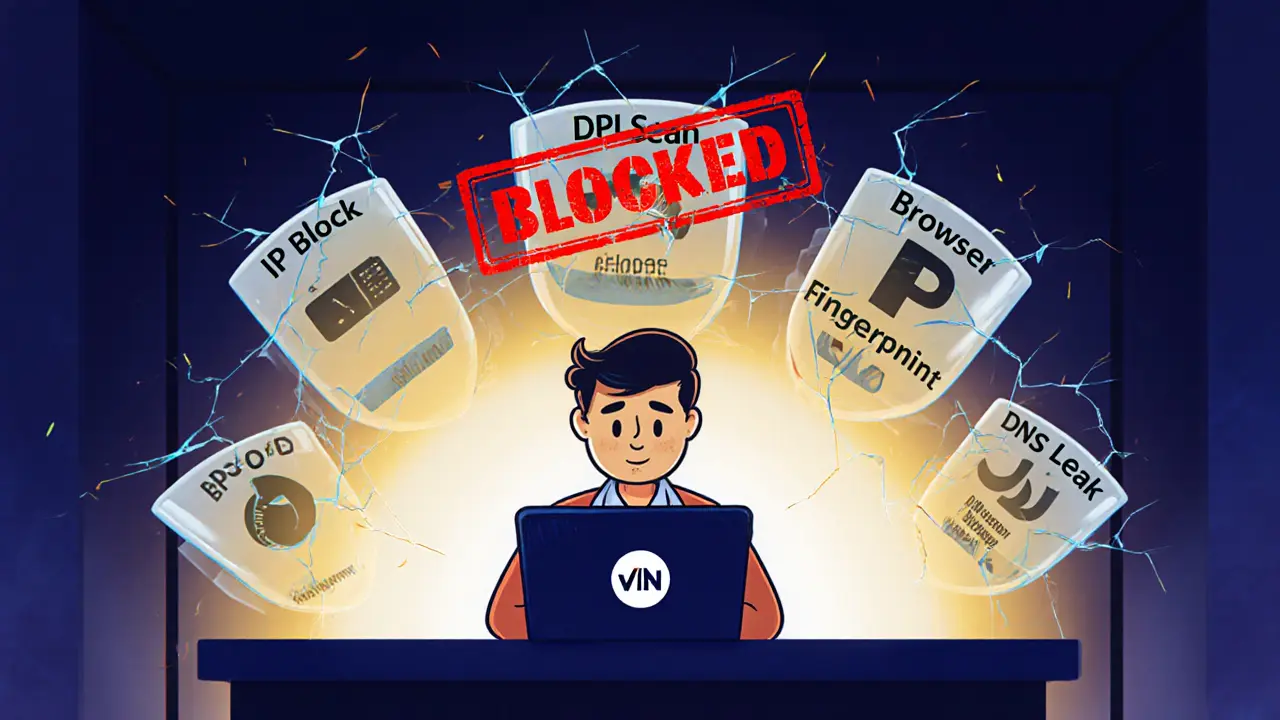

crypto exchange, a platform where you buy, sell, or trade digital assets, often with varying levels of security, fees, and restrictions. Also known as crypto trading platform, it’s the gateway to the market—but not all gateways are safe. This month, we called out Baryon Network as a dead DEX with one trading pair and zero liquidity. Meanwhile, DeepBook Protocol on Sui showed what a real on-chain order book looks like: fast, transparent, and decentralized. Exchanges like Binance and Coinbase kept tightening VPN blocks with browser fingerprinting and behavioral AI. If you’re using a VPN to bypass geo-restrictions, you’re playing a game you’re already losing. The smart move? Use the right exchange for your needs—not the one that lets you sneak in.

And then there’s the rug pull, a scam where developers abandon a project and drain liquidity, leaving investors with worthless tokens. Also known as exit scam, it’s the silent killer of crypto portfolios. Looping Collective and Daisy Launch Pad weren’t just inactive—they had zero community, no audits, and no updates. The red flags were screaming: anonymous team, locked liquidity, fake marketing. You don’t need a PhD to spot these. You just need to ask: Is anyone actually using this? Is there real trading volume? Is the team real? If the answer’s no, walk away.

What You’ll Find in This Archive

This collection isn’t just a list of posts—it’s a survival guide for November 2025’s crypto chaos. You’ll find real breakdowns of airdrops that paid out, exchanges that still work, tax rules you can’t ignore, and projects that were nothing but smoke and mirrors. We didn’t just report on them—we explained why they mattered, who got hurt, and how to avoid the same mistakes. Whether you’re holding a meme coin, staking in DeFi, or just trying to understand your tax bill, this archive gives you the facts without the hype.

30

Nov

30

Nov

29

Nov

29

Nov

Crypto exchanges use advanced multi-layered systems to detect and block VPNs, combining IP blacklists, behavioral analysis, and browser fingerprinting. Learn how Binance, Coinbase, and others catch users bypassing geo-restrictions-and what options still work in 2025.

28

Nov

28

Nov

Learn how to use a liquidity pool impermanent loss calculator to avoid costly mistakes in DeFi. Understand when fees cover losses, which pools are safe, and how to make smarter liquidity decisions.

26

Nov

26

Nov

India taxes Virtual Digital Assets at a flat 30% with no loss offsets or deductions. Learn how TDS, reporting rules, and new 2025 changes affect your crypto investments.

24

Nov

24

Nov

Looping Collective (LOOP) is a crypto project with no exchange listings, no trading volume, and no community. Despite flashy claims, it lacks audits, transparency, and real utility - making it a high-risk, likely non-functional token.

23

Nov

23

Nov

The Bird Finance BIRD airdrop promised rewards but delivered confusion. Learn what really happened, why it failed, and how to avoid similar scams in 2025.

22

Nov

22

Nov

WLBO (WENLAMBO) isn't a typical airdrop - it pays you automatically every time someone trades. Learn how its 10% fee system rewards holders, burns tokens, and supports charity - with no claiming needed.

21

Nov

21

Nov

Compare the top crypto exchanges in 2025-Coinbase for beginners, Binance for traders, Kraken and Gemini for security, eToro for copying investors, and Uphold for multi-asset trading. Find the right platform for your needs.

19

Nov

19

Nov

Bangladesh hit a record $30 billion in remittances in 2025, but crypto remains banned. Learn how mobile apps like bKash are replacing informal systems - and why the central bank refuses to allow Bitcoin or Ethereum.

18

Nov

18

Nov

Qatar bans Bitcoin and other cryptocurrencies but allows tokenized real estate and assets under strict regulations. Learn what’s legal, what’s not, and how to invest safely in 2025.

17

Nov

17

Nov

Alphakek AI (AIKEK) is a crypto project offering AI tools trained specifically on blockchain data. It helps traders analyze markets, detect trends, and generate crypto content using uncensored, self-hosted models. Learn how it works, its tokenomics, and whether it's worth your time.

16

Nov

16

Nov

Wombex Finance and CoinMarketCap are running a New Year airdrop offering up to 47 WMX tokens. Learn how to qualify, avoid scams, and prepare your wallet for this legitimate DeFi campaign.