VDA Tax Calculator

Calculate Your Crypto Tax Liability

Tax Calculation Results

Transaction Summary

Asset:

Profit:

30% Tax:

1% TDS (if applicable):

Total Tax Liability:

India's VDA Tax Rules:

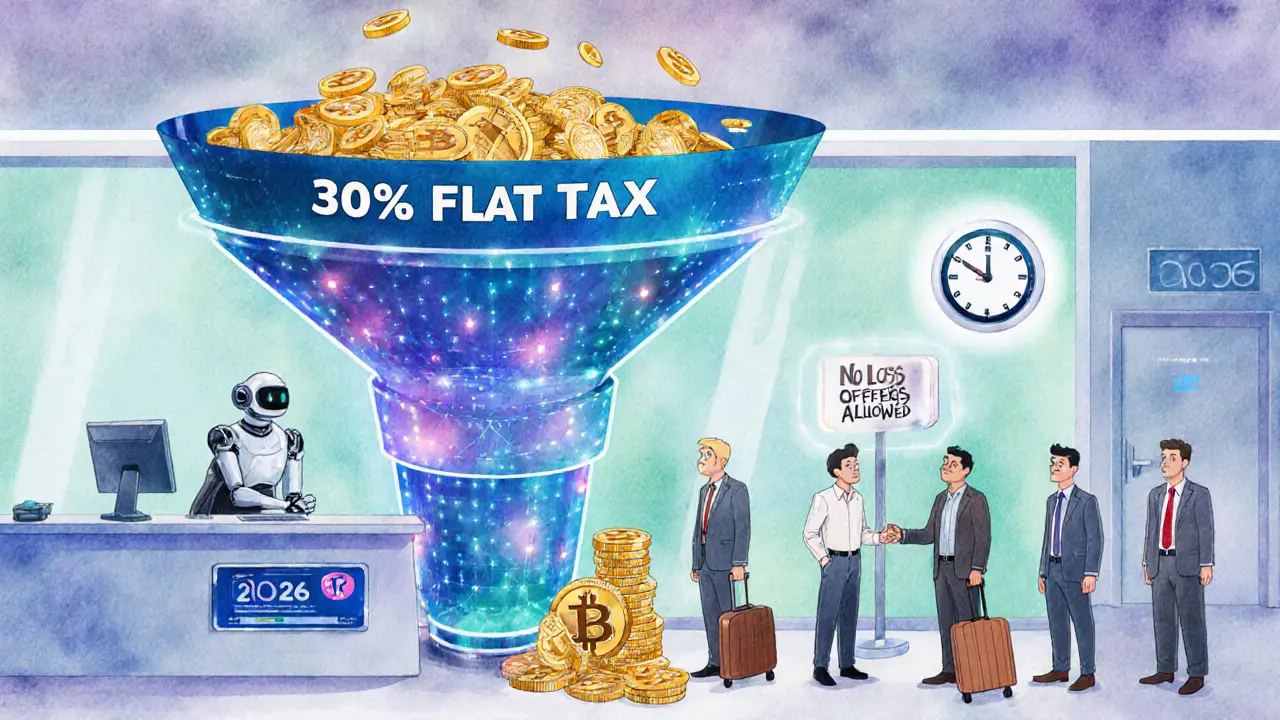

• 30% tax on all gains

• 1% TDS on transactions over ₹10,000

• No loss offsets against other income

Important: This calculator uses India's current VDA tax rules effective from 2025. Losses from VDAs can only offset future VDA gains and must be used within 8 years.

India’s rules for taxing Virtual Digital Assets (VDAs) are some of the strictest in the world. If you’re buying, selling, or holding Bitcoin, Ethereum, NFTs, or any other digital token, you need to know exactly how the tax system works-because mistakes can cost you big time. Unlike traditional investments, there are no deductions, no loss offsets, and no benefit from holding long-term. The system is simple, but harsh. And it’s not changing anytime soon.

What Counts as a Virtual Digital Asset?

Under Section 2(47A) of the Income Tax Act, a Virtual Digital Asset includes anything that represents value digitally and is traded using cryptography. That means Bitcoin, Ethereum, Solana, Dogecoin, NFTs, and even tokens from decentralized finance (DeFi) platforms all fall under this category. What doesn’t count? Indian rupees, foreign currencies, and physical gold or silver. The government made this definition broad on purpose-so nothing slips through the cracks.

Even swapping one crypto for another counts as a taxable event. If you trade 0.5 BTC for 10 ETH, that’s not a simple exchange-it’s a sale of BTC and a purchase of ETH. Both sides of the trade are taxed at 30% on the profit you made.

The 30% Tax Rate: No Exceptions

Here’s the brutal truth: all gains from VDAs are taxed at a flat 30%, no matter your income level. Even if you’re in the 5% tax slab, your crypto profits get hit with 30%. And there’s no indexation benefit. In the past, if you held stocks or real estate for more than two years, you could adjust your purchase price for inflation. That’s gone for crypto. You pay 30% on the full difference between what you paid and what you sold for.

And here’s what you can’t deduct: transaction fees, gas fees, mining costs, wallet fees, or even the cost of buying a hardware wallet. Only the original purchase price of the asset itself counts as a cost of acquisition. Everything else? Gone. So if you bought 1 BTC for ₹30 lakh and sold it for ₹40 lakh, your taxable gain is ₹10 lakh. Even if you paid ₹50,000 in network fees over the year, that doesn’t reduce your tax bill.

Losses Can’t Offset Anything

This is where most investors get blindsided. If you lose money on crypto, you can’t use that loss to reduce your salary tax, your business income, or even gains from stocks or real estate. The law says losses from VDAs can only be used to offset future gains from other VDAs-and even then, only for eight years.

Let’s say you bought Ethereum in 2022 for ₹8 lakh and sold it in 2023 for ₹4 lakh. You lost ₹4 lakh. That loss stays locked in the VDA bucket. You can’t use it to lower your ₹15 lakh salary tax. If you make ₹6 lakh in crypto gains in 2025, you can use ₹4 lakh of your old loss to reduce that gain to ₹2 lakh. But if you never make another crypto profit, that ₹4 lakh loss disappears after eight years. No refund. No carryover to other assets. Just gone.

TDS at 1%: The Hidden Tax

On top of the 30% tax, there’s a 1% Tax Deducted at Source (TDS) on every VDA transaction over ₹10,000 in a financial year. For specified persons-like those with business income under ₹1 crore or professional income under ₹50 lakh-the threshold is ₹50,000. Exchanges like WazirX, CoinDCX, and ZebPay automatically deduct this when you sell or trade.

Here’s the catch: this TDS is not your final tax. It’s just an advance payment. You still have to file your return and pay any additional tax if your 30% liability is higher than what was deducted. If you didn’t give your PAN, the TDS jumps to 20%-a massive penalty for a paperwork oversight.

Many users report errors in TDS calculations. Trustpilot data from Q2 2024 shows 62% of tax complaints on Indian exchanges involve over-deduction-sometimes by 15-22%. If you’re seeing more TDS taken than your actual profit, you’ll get it back when you file your return. But you’ll have to wait until next year’s tax season to see that refund.

How to Report VDA Transactions

You must report all VDA transactions in Schedule VDA of your income tax return. This applies to ITR-2 or ITR-3 forms. You need to list:

- Asset name (e.g., Bitcoin, NFT #1234)

- Date of acquisition

- Date of transfer

- Cost of acquisition (in INR at the time of purchase)

- Full value of consideration (in INR at the time of sale)

- Any TDS deducted

For crypto-to-crypto trades, you must convert both sides to INR using exchange rates from government-approved platforms like CoinDCX or WazirX. The CBDT doesn’t accept CoinGecko or CoinMarketCap for this purpose. If you use the wrong rate, you risk a notice.

Keep blockchain records. Screenshots of your wallet transactions, transaction IDs, and exchange statements are mandatory. According to NISM, 65% of tax disputes in FY2023-24 happened because people couldn’t prove their purchase price or transfer dates.

What About Mining and Staking?

Income from mining or staking is treated as business income. That means it’s taxed at your regular slab rate (up to 30% plus cess). When you later sell those mined coins, you pay another 30% on the gain from the time you received them. So you’re taxed twice: once on the income value when you received the coins, and again when you sell them.

Example: You mine 0.1 BTC in January 2024 when it’s worth ₹3.5 lakh. You report ₹3.5 lakh as business income. In June 2024, you sell it for ₹4 lakh. Now you pay 30% tax on the ₹50,000 gain. That’s ₹15,000 extra. Total tax on that 0.1 BTC? ₹1.05 lakh (30% of ₹3.5 lakh) + ₹15,000 = ₹1.2 lakh. That’s 34.3% total tax on the original ₹3.5 lakh value.

How This Compares to Other Countries

India’s system is extreme. In Portugal, crypto gains are tax-free for individuals. In Singapore, you only pay tax if you’re trading crypto as a business. In Germany, you pay zero tax if you hold for over a year. In the U.S., long-term gains are taxed at 0%, 15%, or 20% depending on income-with losses able to offset other gains.

India’s 30% flat rate with no loss offsets is rare. Only a few countries like France and Belgium have similar structures, but even they allow some deductions. India’s 1% TDS is also unusually high. The EU’s upcoming DAC8 rule proposes 0% TDS for crypto. Japan taxes crypto as miscellaneous income at up to 55%. India’s system is simpler than Japan’s, but far harsher than most.

What Experts Are Saying

There’s no middle ground in expert opinions. Dr. S. Rajeesh from Kerala University says the system saved ₹3,920 crore in FY2023-24-27% more than expected. The simplicity cut compliance time by 60-70% for most taxpayers.

But Pankaj Nahta of Tax2Win says the 30% rate makes crypto unviable for anyone except speculators. He points out that after tax, even a 45% annual return on crypto barely beats a fixed deposit. KPMG’s 2023 survey found 68% of institutional investors cut their Indian crypto exposure by half. BlackRock’s India head said the tax structure makes India non-competitive for global crypto funds-costing $2.1-3.4 billion in potential investment each year.

Real Investor Stories

On Reddit, user ‘CryptoSaverIN’ lost ₹2.87 lakh on Ethereum in 2023 but couldn’t use the loss to reduce his ₹12 lakh salary tax. He called it “financially punitive.”

Another user, ‘NiftyGainer’, found a loophole: converting crypto to Bitcoin ETFs before year-end. Since ETFs are taxed as securities (not VDAs), he got 3.2% higher net returns. He’s not alone. WalletInvestor’s 2024 survey found 44% of Indian traders now gift crypto to family members in lower tax brackets to reduce liability.

Professional traders, though, like ‘TaxWiseTrader’ on TradingQ&A, praise the clarity. “No more guessing if it’s capital gain or business income,” he said. “30% flat? I know exactly what I owe.”

What’s New in 2025?

The Income Tax Act, 2025, passed in August 2025, didn’t change the 30% rate-but it did make enforcement digital-first. The assessment year is now called “Tax Year,” and specialized dispute cells are being set up. The government is also reviewing a new Virtual Asset Service Providers Bill, which could require licenses for exchanges and wallet providers. If passed, this might add another layer of compliance.

ICRA predicts VDA tax revenue will hit ₹9,200 crore by FY2025-26. CRISIL warns that without changes, 12-18% of users may move to offshore platforms by 2026. But EY India believes compliance will hit 70%+ by 2027 as people adapt.

What You Should Do Now

1. Track every transaction-buy, sell, swap, stake, mine. Use a crypto tax tool like Koinly or CoinTracker, and export your data in CSV.

2. Save proof of purchase-screenshots of wallet addresses, transaction IDs, and exchange receipts. Don’t rely on exchange statements alone.

3. Calculate your cost basis correctly. Only the INR value at purchase counts. Ignore fees.

4. Check your TDS. If your exchange deducted more than your actual profit, you’ll get it back-but only if you file correctly.

5. Use ITR-2 or ITR-3. Don’t file ITR-1. You’ll get a notice.

6. Don’t gift crypto to strangers. The tax department tracks large transfers. Gifting to immediate family is fine, but document it.

7. Use CBDT’s TaxAssist VDA chatbot. It answers 12,000+ questions daily and can clarify how to report a specific trade.

Final Reality Check

India’s VDA tax system isn’t designed to encourage crypto. It’s designed to capture revenue from a market that exploded overnight. It’s not fair. It’s not balanced. But it’s the law.

If you’re holding crypto in India, you’re paying more in taxes than in almost any other country. But if you’re still trading, you’re betting that the returns will outweigh the tax hit. That’s a gamble. And right now, the house has the edge.

Know your numbers. Keep your records. File on time. And don’t expect the rules to get easier.

Is crypto taxed in India?

Yes. All gains from Virtual Digital Assets-including Bitcoin, Ethereum, NFTs, and other tokens-are taxed at a flat 30% under Section 115BBH of the Income Tax Act. This applies whether you hold the asset for one day or five years.

Can I offset crypto losses against my salary?

No. Losses from Virtual Digital Assets can only be used to offset future gains from other VDAs. They cannot reduce income from salary, business, or other investments. If you don’t make another crypto profit within eight years, the loss disappears.

What is the 1% TDS on crypto?

A 1% Tax Deducted at Source is automatically withheld by exchanges on every VDA transaction exceeding ₹10,000 in a financial year (₹50,000 for specified persons). This is an advance tax payment, not your final tax. You still need to calculate your 30% liability and pay any difference when filing your return.

Do I pay tax on crypto-to-crypto trades?

Yes. Swapping one cryptocurrency for another is treated as a sale of the first asset and a purchase of the second. You must calculate the profit in INR at the time of the swap and pay 30% tax on it. Use exchange rates from government-approved platforms like CoinDCX or WazirX for valuation.

Can I use losses from stocks to reduce crypto tax?

No. Losses from stocks, real estate, or any other asset class cannot be used to reduce your VDA tax liability. The law treats crypto losses as isolated to the VDA category only.

What documents do I need for crypto tax filing?

You need: (1) Transaction history from exchanges, (2) Wallet addresses with timestamps, (3) Proof of acquisition cost in INR (screenshots of purchase receipts), (4) TDS certificates (Form 26QE), and (5) Records of any crypto-to-crypto trades. Without these, you risk a tax notice.

Is staking income taxable?

Yes. Rewards from staking or mining are treated as business income and taxed at your regular income tax slab rate. When you later sell those tokens, you pay another 30% on the gain from the time you received them.

What happens if I don’t report crypto income?

The Income Tax Department receives transaction data directly from exchanges. If you don’t report, you’ll get a notice. Penalties can include 50-200% of the tax evaded, plus interest. In serious cases, the department may initiate prosecution under the Income Tax Act.

Are NFTs taxed the same as Bitcoin?

Yes. NFTs are classified as Virtual Digital Assets under Indian law. Any profit from buying or selling an NFT is taxed at 30%. The same rules for cost of acquisition, TDS, and loss carryforward apply.

Will crypto tax rules change in 2026?

There are no official plans to change the 30% rate or loss rules in 2026. However, the government is reviewing the Virtual Asset Service Providers Bill, which could add licensing requirements for exchanges. Any changes would likely focus on enforcement, not tax relief.

Sam Daily

Okay, but let’s be real - if you’re still holding crypto in India, you’re either a masochist or a genius. 30% tax with no loss offsets? That’s not taxation, that’s a hostage situation. But hey, if you’re making 5x returns, you’re still winning. Just don’t cry when your wallet’s lighter than your conscience. 🚀

SHIVA SHANKAR PAMUNDALAR

India’s tax system doesn’t care if you’re poor or rich - it just wants your crypto blood. The government didn’t create a tax law. They created a crypto extraction machine. And we’re all just rats in the wheel, thinking we’re trading. We’re not trading. We’re paying tribute.

Rachel Thomas

Wait so if I lose money I can’t use it to pay my rent? That’s insane. My landlord doesn’t care if I lost 5 lakhs on Dogecoin. He just wants cash. This is why I hate finance.

Wilma Inmenzo

1% TDS? That’s just the tip of the iceberg. They’re tracking every transaction. Every wallet. Every swap. Next thing you know, they’ll be taxing your dreams. They already know you bought Bitcoin in 2017. They know everything. Don’t trust the system. It’s a trap.

Shelley Fischer

The structural rigidity of India’s VDA taxation framework is, frankly, a masterclass in revenue maximization at the expense of market efficiency. The absence of loss carryforward mechanisms across asset classes represents a significant distortion in capital allocation, and the unilateral imposition of TDS without proportional relief mechanisms undermines the principle of progressive equity in fiscal policy.

Puspendu Roy Karmakar

Bro, I get it. It’s harsh. But at least now we know exactly what we owe. No guesswork. No loopholes. I just use Koinly, export CSV, file ITR-2, and done. 30% is a lot, but I’d rather pay 30% than get a notice from IT dept. Been there. Done that. Won’t go back.

Evelyn Gu

I just... I just don’t understand how people can still trade crypto here. I mean, you lose money? Tough. You can’t use it. You make money? You lose 30% immediately. And then there’s TDS, and then you have to track every single swap, every single transaction, every single gas fee, and you can’t even deduct the cost of your hardware wallet? It’s like the government is saying, ‘We know you’re trying to make money, but we’re going to make it so painful you’ll just give up.’ And honestly? Maybe they’re right. Maybe I should just put it in a fixed deposit and sleep at night.

Michael Fitzgibbon

It’s wild how the same people who scream about ‘financial freedom’ are the first to get mad when the system doesn’t bend to their trades. India’s rules are brutal, but they’re clear. No ambiguity. No loopholes. Maybe that’s the real gift here - you know where you stand. It’s not fair, but it’s not confusing. And sometimes, that’s better.

Tina Detelj

Is this really progress? Or is this just the state saying: ‘We don’t understand this thing called crypto, so we’ll tax it like it’s a luxury yacht?’ We’re not talking about yachts - we’re talking about decentralized networks, peer-to-peer value transfer, digital sovereignty. And instead of adapting, they’re just slapping on a 30% tax like it’s a toll booth on the highway to the future. What are we even building here?

George Kakosouris

30% flat tax? No indexation? No loss offset? This is not a tax policy - it’s a crypto extermination protocol. They’re not regulating; they’re sterilizing. Institutional capital won’t touch this. Retailers are being cannibalized. The 1% TDS is just the first layer of the onion - next they’ll audit your MetaMask. You think you’re trading? You’re being harvested.

Tony spart

Indians think they’re smart with their crypto but they’re just getting robbed. America doesn’t do this. Germany doesn’t do this. Why is India so greedy? You want my money? Come get it. But don’t act like you’re helping. You’re just scared of innovation.

Ben Costlee

I know this feels unfair. But imagine being a tax officer trying to track millions of crypto trades with no system in place. Maybe this is the only way they could make it work. It’s not perfect. But it’s a start. And if you’re still in the game, you’re not just a trader - you’re a pioneer. Keep going. Just document everything.

Mark Adelmann

Just use Koinly. Set it and forget it. Export CSV. File ITR-2. Done. The tax sucks, but at least you’re not getting a notice. I’ve been doing this for 3 years. I know the drill. You got this.

ola frank

The marginal utility of capital gains taxation under Section 115BBH is functionally equivalent to a Pigouvian tax on speculative liquidity, yet the absence of a corresponding mechanism for loss realization creates a negative externality on market depth and price discovery. The 1% TDS, while administratively efficient, introduces a non-linear friction in micro-trading dynamics - particularly for retail participants operating below the ₹50,000 threshold. This is not tax policy; it’s behavioral nudging via fiscal coercion.

imoleayo adebiyi

Bro, I live in Nigeria, and we have no rules for crypto. But I still think India’s system is better than nothing. At least you know where you stand. Here? We just pray and hope the government doesn’t ban it tomorrow. You’re lucky you have a system, even if it’s harsh.

Angel RYAN

It’s not about whether it’s fair. It’s about whether you’re prepared. If you’re trading crypto in India, you signed up for this. Track your stuff. Use the tools. File on time. You’ll be fine. Don’t make it harder than it is.

stephen bullard

I used to think crypto was about freedom. Now I think it’s about resilience. You’re not just investing in Bitcoin - you’re investing in your ability to deal with bureaucracy, paperwork, and a system that doesn’t care if you lose money. That’s the real test. And honestly? I’m proud of everyone still in the game.

SHASHI SHEKHAR

Guys, I made a spreadsheet for this. I track every single transaction - buy, sell, swap, stake, even gas fees. I use CoinTracker + Excel. I tag every wallet. I screenshot every transaction ID. I even note the exchange rate from CoinDCX because CBDT doesn’t accept CoinGecko. I lost 4 lakhs last year? Yeah. Can’t offset. But I still filed everything. No notices. No stress. You can do it too. I’ll share the template if you DM me. 🙌

Vaibhav Jaiswal

They tax the hell out of crypto but still let people buy gold without any reporting. Funny, right? Gold is physical. Crypto is digital. But the government trusts gold more than blockchain. That’s the real joke.

Abby cant tell ya

You’re all just delusional if you think this is about revenue. It’s about control. They don’t want you to be rich. They want you to be obedient. And if you’re still trading crypto? You’re a rebel. And rebels get punished.

Tom MacDermott

Let me guess - you’re one of those people who thinks ‘30% is fair’ because you ‘know your numbers.’ Congrats. You’re the tax collector’s favorite pet. Meanwhile, I’m over here turning my losses into NFTs of my own face crying. At least I’m getting art out of this.

Komal Choudhary

Wait so if I gift crypto to my mom who’s in a lower tax bracket, is that legal? I mean, I saw someone do it. But what if IT dept says it’s a sham? I’m scared. I don’t want to get audited. Someone please help.

priyanka subbaraj

They didn’t make this law to help you. They made it to scare you into giving up. And you’re still here? Pathetic.

Sierra Myers

Just file ITR-2. Don’t overthink it. If you’re losing money, you’re not really trading - you’re just giving the government a donation. Save your energy. Use Koinly. Done.

Ben Costlee

Don’t gift to strangers. That’s a red flag. But family? Document it. Send a simple message: ‘Gifting 0.5 BTC as a personal gift, no expectation of return.’ Keep it. That’s enough. You’re not a criminal. You’re just trying to be smart.