Token Liquidity Checker

Check Token Liquidity

Enter a token name or symbol to verify if it has real trading activity and exchange listings. This tool helps identify potential risks like fabricated prices and zero-volume tokens.

Looping Collective (LOOP) is a cryptocurrency that claims to be a community-driven DeFi ecosystem built around something called liquid looping tokens. But if you’re looking to understand what LOOP actually is - not just what its website says - you’ll find a lot of noise and very little substance.

What LOOP claims to do

The official website, loopingcollective.org, says LOOP is the engine behind a set of tokenized yield products. These include LHYPE (for HYPE token holders), wHLP (for HLP token holders), and upcoming ones like LHLP and LcBTC. The idea is simple on paper: you lock up your crypto, and LOOP gives you better returns through automated DeFi strategies. It calls itself a "token-flywheel" - meaning the more people use it, the more value LOOP generates for everyone involved. It sounds like a lot of other DeFi projects. But here’s the catch: LOOP doesn’t have any real trading activity. Not on major exchanges. Not on decentralized ones. Not even on smaller platforms with verifiable volume.Where LOOP stands in the market

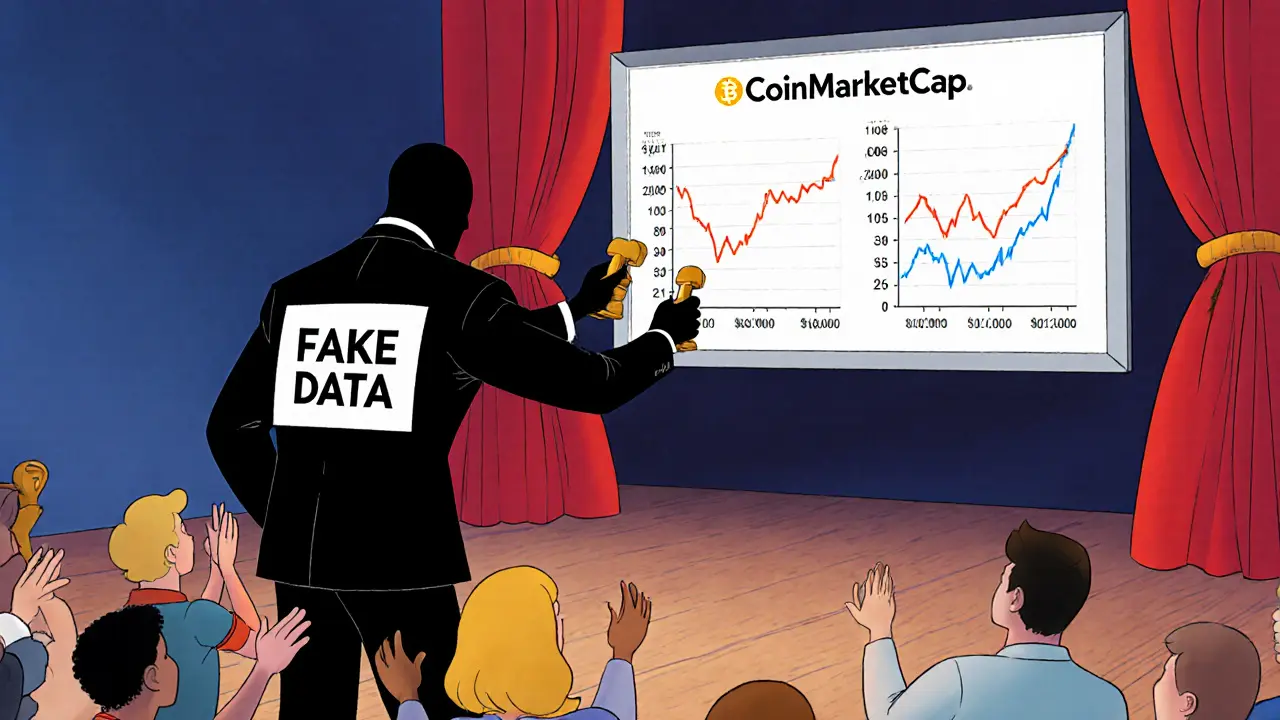

As of November 2025, LOOP has a total supply of 1 billion tokens. Only about 151 million are listed as circulating. That sounds like a lot - until you look at the price. CoinMarketCap shows LOOP trading at $0.0049, giving it a market cap of just $790,000. That puts it at #8642 out of nearly 25,000 cryptocurrencies. In other words, it’s in the bottom 1%. Even worse, CoinMarketCap reports $0 in 24-hour trading volume. Binance shows a price, but also lists a $0 market cap. Crypto.com has a price, but no volume data. And CoinCarp - one of the more reliable crypto data aggregators - explicitly states: "Looping Collective has yet to be listed on any cryptocurrency exchanges." This contradiction is a red flag. How can multiple sites show prices if the token isn’t traded anywhere? The answer: the prices are likely fabricated. Wash trading, fake listings, or bot-generated data are common tricks used to make low-cap tokens look alive when they’re not.No exchange listings = no real value

If a cryptocurrency isn’t listed on any exchange - centralized or decentralized - it can’t be bought or sold by real people. That means the price you see is meaningless. It’s like seeing a "price" for a house that’s never been put on the market. The number might exist on a website, but it doesn’t reflect reality. You can’t buy LOOP on Binance, Coinbase, KuCoin, or Uniswap. There are no trading pairs. No liquidity pools. No order books. That’s not a bug - it’s a dealbreaker. Without liquidity, the token has no utility. You can’t use it to earn yield, swap it for other assets, or cash out if you need to.No community, no trust

Every successful crypto project - even small ones - has a community. Telegram groups. Discord servers. Reddit threads. Twitter/X accounts. Active users asking questions, sharing updates, reporting bugs. LOOP has none of that. As of November 2025, there are no public Discord or Telegram channels linked from their website. No active Twitter account. No Reddit community. No comments on CoinMarketCap. Zero user votes on Binance’s sentiment tracker. That’s not normal. It’s not "new." It’s suspicious. Compare this to projects like Lido (LDO) or Rocket Pool (RPL), which offer similar liquid staking services. They have tens of thousands of followers, daily discussions, and transparent governance. LOOP has silence.

No audits, no transparency

Legitimate DeFi projects get audited. By CertiK. By Hacken. By PeckShield. These firms check the smart contracts for bugs, exploits, and backdoors. It’s standard practice. It’s expected. Looping Collective doesn’t mention any audits. Not on their website. Not in their whitepaper (if they even have one). No security reports. No GitHub activity. No code repository you can review. That’s a massive red flag. If you’re going to lock your crypto into a "tokenized yield strategy," you need to know the code is safe. Without audits, you’re gambling. And in crypto, gambling without a safety net is how people lose everything.What about the "coming soon" products?

The website says LHLP and LcBTC are "coming soon." There’s even a "Join the Waitlist" button. But waitlists don’t mean anything if the core product doesn’t work. You can’t join a waitlist for a product that doesn’t exist yet - especially when the main token isn’t even tradable. It’s like signing up for a new phone model when the company hasn’t built a factory yet. And there’s zero information on how these products will work. What’s the APY? What’s the minimum deposit? What wallets are supported? What are the fees? Nothing. No documentation. No tutorials. No FAQs.Who is this for?

Looping Collective isn’t for beginners. It’s not for experienced traders. It’s not even for people who just want to dabble in DeFi. It’s for people who don’t know enough to ask the right questions. The ones who see a shiny website, hear the word "DeFi," and think they’re getting in early. The project’s marketing language - "token-flywheel," "realigning incentives," "co-creating the ecosystem" - is vague by design. It sounds smart, but it doesn’t explain anything. Real projects explain their tech. LOOP hides behind buzzwords.

Jennifer Morton-Riggs

LOOP is just a fancy PowerPoint deck with a blockchain sticker on it. No volume, no community, no audits - it’s not a project, it’s a mood board for crypto scammers.

Kathy Alexander

Someone’s gotta be dumb enough to buy this. I’m not mad, I’m just disappointed. The fact that CoinMarketCap even shows a price is a crime.

Gus Mitchener

The token-flywheel metaphor is a classic case of ontological inflation - it reifies process as substance. There’s no feedback loop because there’s no actual transactional substrate. It’s semiotic vaporware wrapped in DeFi jargon to simulate legitimacy.

The absence of exchange listings isn’t a technical oversight - it’s an epistemological void. You can’t have value without exchange, and you can’t have exchange without liquidity. LOOP is a semantic ghost.

When a project relies on ‘realigning incentives’ without defining the agents, the actors, or the constraints, it’s not innovation - it’s linguistic obfuscation masquerading as disruption.

Compare this to Lido or Rocket Pool: their whitepapers are dense, their GitHub commits are frequent, their governance forums are active. LOOP’s website reads like a corporate retreat slide deck written by a grad student who never coded a smart contract.

The ‘coming soon’ products? That’s not a roadmap. That’s a magic trick where the rabbit was never in the hat to begin with.

This isn’t a high-risk investment. It’s a zero-risk investment - because there’s nothing to lose. Your money doesn’t disappear. It just never existed in the first place.

People keep chasing ‘early access’ like it’s a religion. But the only thing you’re early to is being the first to fund a hallucination.

The real DeFi revolution isn’t in tokens with zero volume. It’s in transparent, audited, community-owned protocols that let you verify everything - not just trust a website that says ‘trust us’.

LOOP doesn’t need to be debunked. It needs to be forgotten.

Soham Kulkarni

bro this is so sad. i saw this on twitter and thought maybe its real. no exchange, no discord, no nothing. just a website with fancy words. dont waste time.

Tejas Kansara

Stick to Aave or Curve. This is a trap.

Rajesh pattnaik

India has seen so many fake crypto projects. This feels familiar. No audit, no team, no trading. Just vibes and promises.

Lisa Hubbard

I mean, I get it, people want to believe in something, right? Like, we all want to find the next Bitcoin before it explodes. But this isn’t even a seed. It’s a thought. A whisper in a crowded room. You can’t build a house on a whisper. You need bricks. You need mortar. You need someone who’s actually built something before. LOOP has none of that. It’s just a website with a logo that looks like it was made in Canva by someone who thinks ‘DeFi’ is a personality trait. And now people are signing up for waitlists? Like it’s a new iPhone? Bro. Just… no.

Daryl Chew

They’re using fake volume to pump it before the rug pull. I’ve seen this before. The same exact pattern. CoinMarketCap is compromised. Binance is in on it. They’re waiting for retail to buy in, then they’ll vanish with the liquidity. This isn’t crypto. This is a state-sponsored scam.

Tyler Boyle

Let’s be real - most of these low-cap tokens are just vanity projects for people who want to be ‘crypto founders’ without knowing how to code. LOOP’s whole premise is built on the assumption that people won’t check the data. And honestly? Most won’t. They’ll see ‘DeFi’ and ‘yield’ and think they’re smart. But if you dig one inch below the surface, it’s all smoke. No audits? No exchange listings? No GitHub? That’s not ‘early stage.’ That’s ‘not even started.’ And the fact that people are still talking about it like it’s viable? That’s the real red flag.

The ‘token-flywheel’ nonsense is just buzzword bingo. Real DeFi doesn’t need metaphors. It needs code. And code that’s been audited. And liquidity that’s verifiable. LOOP has none of that. It’s a ghost town with a .org domain.

Jane A

Stop giving this thing oxygen. It’s not a coin. It’s a scam. End of story.

jocelyn cortez

i just feel bad for people who get sucked in. they think they’re being smart. but this is just noise with a website.

John Borwick

USA has too many of these fake tokens. Why does nobody regulate this? It’s like letting anyone sell ‘magic pills’ online. This is why crypto looks bad. People like me don’t even want to touch it anymore.

Jennifer MacLeod

Looping Collective? More like Looping to the moon… in a balloon with no oxygen.

Julissa Patino

why do people still fall for this. no exchange no audit no team. just a website and a dream. america is so gullible. this is why we lose money.

Omkar Rane

man i read this whole thing and i just feel tired. why do we keep doing this? we see the same pattern over and over. shiny site, no code, no volume, then poof. i just hope someone learns. but i doubt it.