Airdrop Verification Tool

This tool helps you verify if a crypto project and airdrop are legitimate. Enter the project details and we'll check key indicators like team transparency, security audits, and blockchain activity. Based on your input, we'll provide a verification score to help you avoid scams like the Bird Finance BIRD airdrop.

Enter project details and click Verify to see results

By November 2025, the Bird Finance BIRD airdrop has become one of the most confusing stories in DeFi. People spent weeks checking wallets, joining Telegram groups, and following Twitter accounts-only to find out later that the airdrop either never happened, was delayed indefinitely, or got swallowed by a sea of lookalike projects. If you’re reading this now, you’re probably wondering: BIRD airdrop, did I miss it? Was it real? And who actually got paid?

What Was Bird Finance Supposed to Be?

Bird Finance wasn’t another meme coin. It was a DeFi platform built around something called a smart pool. Think of it like an automated yield optimizer that scans multiple blockchains-Solana, Ethereum, HECO, OKExChain-to find the best places to stake your crypto and earn rewards. Instead of you hunting for high-yield farms, Bird Finance’s algorithms did it for you. The native token, BIRD, was meant to be the fuel for this system.The tokenomics were aggressive. Half of all BIRD tokens-50%-were sent to a blackhole address right at launch. That meant the total supply kept shrinking with every transaction. On top of that, every time someone traded BIRD, a 6% fee kicked in:

- 2% went to the liquidity pool (to keep trading stable)

- 2% went to the DAO treasury (so holders could vote on changes)

- 2% got distributed to everyone holding BIRD (a passive reward)

This wasn’t just a token. It was a self-sustaining machine designed to burn supply, reward holders, and give power to the community. But here’s the problem: the machine never fully started.

The Airdrop That Never Quite Showed Up

Back in late 2024, the official announcement claimed the BIRD airdrop would launch on November 30, 2024. People scrambled. They connected wallets. They followed social media accounts. They filled out forms. Some even bought small amounts of BIRD just to qualify.Then, in December, the team posted a vague update: "The airdrop has been postponed to Q1 2025." No new date. No explanation. Just silence.

By March 2025, there was still no distribution. No transaction records on the blockchain. No wallet addresses showing up with BIRD tokens. By June, the official website stopped updating. The Twitter account went quiet. The Telegram group had fewer than 200 active members.

And here’s where things got messy.

The Name Confusion Problem

There are at least three different projects using "BIRD" as a token symbol-and all of them did airdrops. You weren’t just chasing one thing. You were chasing ghosts.- Birdchain (a decentralized messaging app on Solana) airdropped 1 million BIRD tokens in January 2025 to users who joined their Telegram group and verified their phone number.

- Birds (a Sui blockchain Mini App game) gave out BIRD tokens to players who reached level 10 and kept their Sui wallet connected. That airdrop happened in December 2024.

- Bird Finance (the DeFi platform) never confirmed a single airdrop distribution.

People who thought they got BIRD from Bird Finance ended up with tokens from Birdchain. Others got tokens from the Sui game and assumed they were part of the DeFi project. Wallets got cluttered. Confusion spread. Scammers noticed.

What You Had to Do to Qualify (If It Had Worked)

According to archived pages from Bird Finance’s website, here’s what they said you needed:- Connect a crypto wallet (MetaMask, Phantom, or Trust Wallet)

- Follow their official Twitter and Telegram accounts

- Complete a registration form with your wallet address and social handles

- Hold at least 100 BIRD tokens in your wallet before the snapshot date

But here’s the catch: no snapshot date was ever published. No blockchain explorer showed a single address being marked for distribution. No smart contract was deployed to handle the token transfer. The entire process existed only as text on a website that’s now offline.

Why Did It Fail?

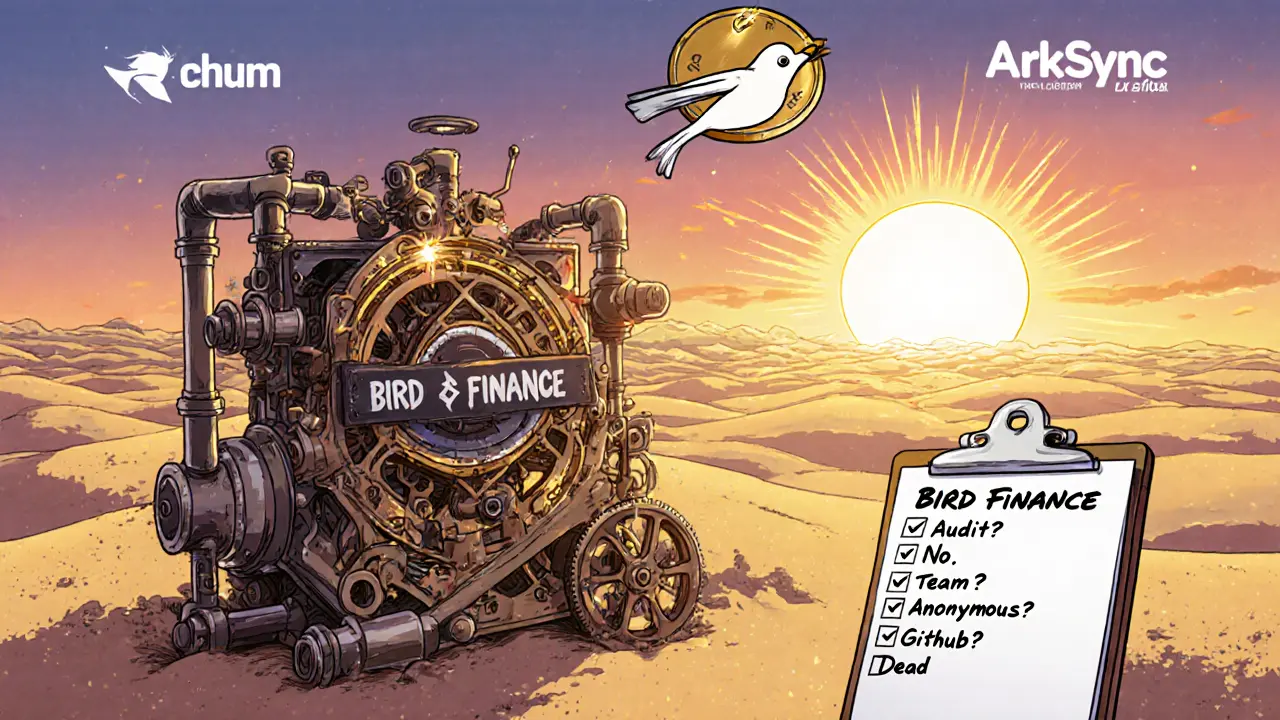

There’s no official statement, but the signs point to three likely reasons:- No audit. Bird Finance never published a security audit from a reputable firm like CertiK or SlowMist. In DeFi, that’s a red flag. No serious investor trusts a platform without one.

- Lack of transparency. The team never revealed who was behind the project. No LinkedIn profiles. No real names. Just pseudonyms and a Discord server.

- Too much competition. In 2025, Pump.fun and Phantom were dominating the airdrop space with real traction. Bird Finance was just another noise in a crowded room.

Even experienced DeFi users who followed the project closely admitted they couldn’t find any evidence of development after January 2025. No GitHub commits. No new contracts. No team updates. Just a website stuck in 2024.

What Happens Now?

As of November 2025, the BIRD token from Bird Finance still trades on a few obscure decentralized exchanges-but with almost no volume. The price is under $0.001. Liquidity pools are nearly empty. The DAO treasury hasn’t voted on anything in over six months.If you participated in the airdrop and never received tokens, you’re not alone. Most people didn’t get anything. If you bought BIRD hoping for a quick flip, you’re likely holding a token with no utility, no community, and no future.

There’s no refund. No recovery. No official channel to contact the team. The project is effectively dead.

What You Should Learn From This

This isn’t just about Bird Finance. It’s about how the airdrop ecosystem works-and how easy it is to get tricked.- Never trust a project without a public team. If you can’t find who’s running it, walk away.

- Check for audits. No audit? High risk.

- Verify the blockchain. Use Etherscan, Solana Explorer, or SuiScan to see if tokens were actually sent. Don’t rely on Twitter posts.

- Watch for name confusion. "BIRD" is a common word. Always double-check the contract address before interacting.

- Assume airdrops are a gamble. Even legit projects sometimes delay or cancel. Don’t invest money you can’t afford to lose.

The BIRD airdrop didn’t fail because of bad luck. It failed because it was built on hype, not substance. And in crypto, hype always collapses.

Still Want to Chase Airdrops?

If you’re serious about finding real airdrops, focus on projects with:- Clear, verifiable teams

- Public audits

- Active GitHub repositories

- Real user growth (not just Telegram bots)

- Tokenomics that make sense

Look at projects like Arbitrum, zkSync, or even newer ones like LayerZero. They don’t need to shout. Their on-chain activity speaks for itself.

The BIRD airdrop? It’s a lesson. Not a loss.

Did anyone actually receive BIRD tokens from Bird Finance?

No verifiable records exist of any BIRD token distribution from Bird Finance. While some users claim to have received tokens, those were almost certainly from other projects like Birdchain or the Sui "Birds" game. No official blockchain transaction confirms Bird Finance completed its airdrop.

Is the BIRD token still tradable?

Yes, but only on low-volume decentralized exchanges like Uniswap and PancakeSwap. The trading volume is negligible, and liquidity is extremely thin. Most traders avoid it because there’s no clear use case or development activity behind the token.

How can I tell if a BIRD airdrop is real?

Check the contract address on a blockchain explorer. Real projects always publish their official contract address on their website and social media. Never connect your wallet to a site you found via a Twitter link. Always verify the address matches what’s listed on their official channel. Look for audits, team members, and active development-those are the real signs of legitimacy.

Why did Bird Finance disappear?

The most likely reasons are lack of funding, no audit, and an anonymous team. Without transparency or community trust, DeFi projects can’t sustain momentum. Bird Finance never launched its core product-smart pools-so the token had no utility. Once hype faded, so did the project.

Should I still hold BIRD tokens I got from Bird Finance?

If you received BIRD tokens from Bird Finance, treat them as worthless. There’s no roadmap, no team, no exchange listings, and no plan to revive the project. Holding them won’t make you money-it will just clutter your wallet. Consider transferring them to a burn address or simply ignoring them.

Are there any safe airdrops to look for in 2025?

Yes. Focus on Layer 2 networks like Arbitrum, zkSync, and Base-they’ve distributed tokens to early users. Also watch projects with real user adoption, like Lens Protocol, Farcaster, or Superfluid. Avoid any airdrop that asks you to send crypto to qualify. Legit airdrops never require you to pay.

Jenny Charland

lol i thought i got bird coins but turned out i got some birdchain junk 😅

Emily Michaelson

This is why you always check the contract address. I lost $200 on this too. No audit, no team, no GitHub. Red flags everywhere. Don't trust hype, trust on-chain data.

Anne Jackson

I'm so tired of these fake airdrops. Americans are getting scammed left and right because they're too lazy to do basic research. If you don't know how to read a blockchain explorer, you shouldn't be in crypto. This is why we need better education.

David Hardy

same. i bought 500 BIRD thinking i was getting rich. now it's worth less than my coffee. 🤡

Dave Sorrell

The failure of Bird Finance underscores a critical pattern in DeFi: lack of transparency and absence of third-party audits are reliable indicators of high-risk projects. Users must prioritize verifiable data over promotional content.

stuart white

Oh my god. This isn't a failure-it's a masterpiece of deception. The team didn't just vanish, they orchestrated a symphony of confusion. They knew people would confuse it with Birdchain. They COUNTED on it. This wasn't incompetence. This was a scam with a PowerPoint.

Daryl Chew

They’re all connected. The same people behind Bird Finance are running 7 other fake airdrops. I’ve seen the wallet transfers. They use the same IP addresses. The whole DeFi airdrop space is a CIA psyop to drain retail wallets. They’re not trying to build-they’re trying to disappear.

Lisa Hubbard

I mean... I didn't even bother checking. I just saw 'BIRD' and 'airdrop' and thought 'free money'. Now I'm just sitting here with a wallet full of junk and a sinking feeling that I'm the dumbest person in crypto. I'm not even mad. Just... tired.

Belle Bormann

i think i got the real bird but im not sure bc my wallet is mess and i think i clicked on a fake link. oops. sorry for the typos

Sky Sky Report blog

The lesson here is simple. Trust is earned through transparency. No team. No audit. No updates. No community. That’s not a project. That’s a ghost.

Omkar Rane

in india we have so many fake airdrops too. people think crypto is easy money. but no one teach you how to check contract or read whitepaper. i lost my rent money on this. now i just use telegram bot to warn others. it's sad but true.

Tyler Boyle

You’re all missing the bigger picture. This isn’t about Bird Finance. It’s about the collapse of the airdrop economy. Every project now is a race to the bottom-hype, no substance, exit liquidity. The only winners are the devs who cash out before the rug pull. The rest of us? We’re the liquidity. We’re the fuel. And we’re burning.

jocelyn cortez

I feel for everyone who got caught up in this. I’ve been in crypto since 2017 and I still get fooled sometimes. It’s not your fault. It’s the system. But please, don’t give up. Just be more careful next time.

Jody Veitch

This is exactly why American crypto culture is doomed. People treat blockchain like a lottery ticket. No due diligence. No accountability. No shame. You don’t get to be a victim of your own laziness and then cry on Reddit. This is capitalism. You win or you lose. You chose to gamble. Now live with it.

asher malik

I wonder... if a project disappears, does it ever truly exist? Was Bird Finance real? Or was it just a collective hallucination fueled by Twitter bots and Telegram spam? Maybe the token was never meant to be traded. Maybe it was just a mirror. And we all stared into it... hoping to see wealth.

Julissa Patino

bird finance was a rug pull disguised as a yield farm. the team used jargon like 'smart pool' and 'dao treasury' to sound legit. but no audit? no team? no code commits? come on. this is basic due diligence. why are people still falling for this? i swear the crypto space is full of 14 year olds with discord accounts.

Soham Kulkarni

bro i just got airdrop from birdchain and thought it was bird finance. i was so happy till i checked the contract. now i just ignore all airdrops. life is too short for this stress

Rajesh pattnaik

in india we call this 'jugaad'-finding a shortcut. but in crypto, shortcuts lead to dead ends. i told my cousin not to join. he didn’t listen. now he’s depressed. we need more awareness, not more tokens.

preet kaur

I’m from India too. Saw this happen to so many friends. We’re not stupid-we’re just hopeful. Maybe next time we’ll know better. But for now, I’m just glad I didn’t send any crypto. Just followed links. Lesson learned. No more free lunches.