Crypto bear markets typically last 9 to 14 months, with the 2021-2023 slump lasting 14 months. Historical patterns show recovery takes years, but institutional involvement is shortening cycles. Learn what drives bear markets and how to survive them.

How Long Do Crypto Markets Last?

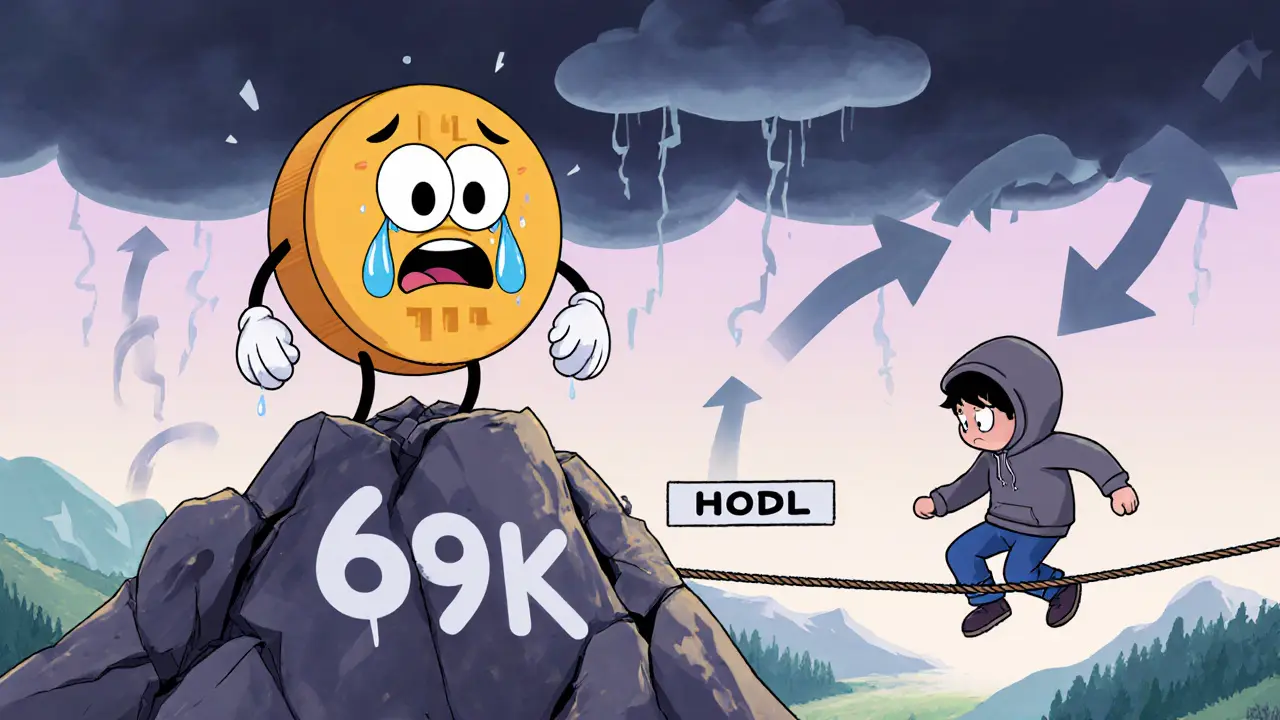

When people ask how long crypto markets last, the typical rise and fall of cryptocurrency prices over time, they’re really asking: When do I get in? When do I get out? There’s no magic number—crypto markets don’t run on calendars. They run on human behavior, technology shifts, and money flow. A bull market might stretch for 18 months, or it might collapse in six. A bear market can drag on for years, or it might flip fast when a major update drops or a big investor starts buying again.

What you see as a "market" is actually a mix of crypto market cycles, repeating patterns of price growth, peak, decline, and recovery in digital assets, crypto bull markets, periods of strong price increases driven by speculation, adoption, and new capital, and crypto bear markets, extended periods of falling prices, low confidence, and reduced trading activity. Bitcoin’s halving events have historically triggered new bull runs—every four years, miners get paid less, supply slows, and demand often catches up. Ethereum’s shift to proof-of-stake didn’t just change how it works—it changed how people think about its value. These aren’t random. They’re systems with rules, even if those rules keep evolving.

But here’s the thing: most people don’t trade markets. They trade hype. A coin spikes because someone on Twitter says it’s the "next Bitcoin." Then it crashes because the team never delivered. That’s not a market cycle—that’s a scam cycle. Real market movements tie to adoption, utility, and real money moving in and out. Look at SunContract—people use it to trade solar power. That’s not speculation. That’s a use case that lasts. Or look at UAE crypto tax rules: zero capital gains? That’s drawing real traders in, not just gamblers. These are the forces that shape how long a market stays hot.

There’s no fixed end date for a crypto market. But there are signs you can spot: when every Discord server is full of "100x" claims, when you’re seeing ads for crypto ATMs on billboards, when your uncle starts asking how to buy Solana—that’s usually near the top. When the news is all about hacks, bankruptcies, and regulators cracking down? That’s often the bottom. The market doesn’t die. It resets. And the next one always starts with someone quietly buying the dust.

Below, you’ll find real breakdowns of tokens that survived cycles, exchanges that failed under pressure, airdrops that turned into scams, and projects that actually built something lasting. No fluff. Just what happened, why it mattered, and what it tells you about where the next move might be.