Crypto Bear Market Duration Calculator

Estimate how long the current crypto bear market might last based on historical patterns and market conditions.

Market Conditions

Estimated Bear Market Duration

(Based on historical patterns)

Typical range: 6-14 months

Based on current conditions, consider $18,000 as a potential bottom and dollar-cost averaging.

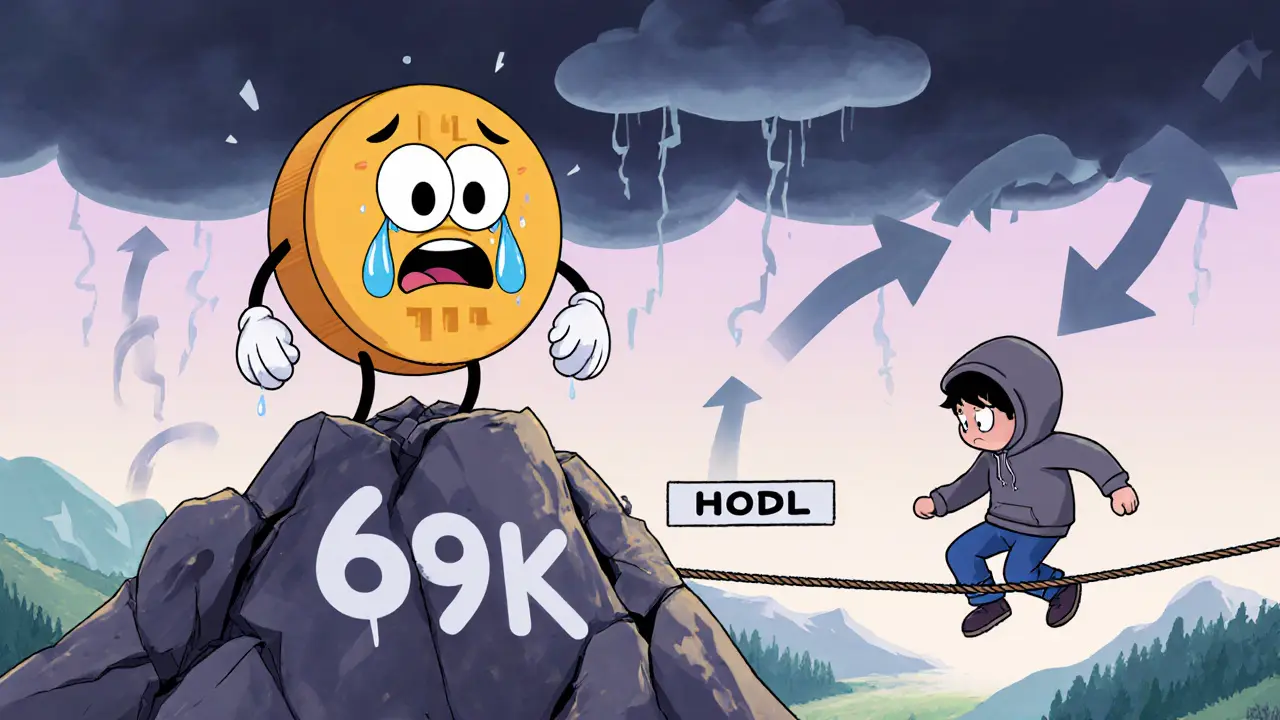

When Bitcoin dropped from $69,000 in November 2021 to $16,500 in January 2023, many investors panicked. Some sold. Others held on, hoping it would bounce back. But the real question wasn’t whether it would recover - it was how long the pain would last. And that’s the question so many people ask when the market turns sour: How long do crypto bear markets last?

There’s No Single Answer, But History Gives Us a Range

Crypto bear markets don’t follow a clock. They don’t end on a set date. But they do follow patterns - and those patterns give us a useful range. Based on data from the last three major cycles, most crypto bear markets last between 9 and 14 months. The 2017-2018 drop took about 13 months. The 2021-2023 slump lasted 14 months. That’s not a coincidence. It’s a rhythm.The average? Around 9.6 to 10 months, according to multiple analyses from AInvest and TradeThatSwing. But don’t mistake average for guarantee. Some bear markets end faster - as short as 4 to 5 months - if the market finds support quickly. Others drag on. The longest recorded crypto bear market lasted 1 year and 8 months. That’s longer than most people expect, but not unheard of.

Compare that to traditional markets. The S&P 500’s bear markets usually last 1 to 2 years. The 2008 crash took nearly two years to bottom out. Crypto’s bear markets are shorter - but they’re also steeper. Bitcoin lost 75% of its value in 2022. The S&P 500 lost 25% in its 2022 bear market. Crypto doesn’t just dip - it dives.

Why Do Bear Markets Happen? It’s Not Just Fear

People say crypto bear markets are caused by fear. That’s true - but only part of the story. The real drivers are deeper:- Bitcoin’s halving cycle: Every four years, Bitcoin’s block reward is cut in half. Historically, this triggers a bull run 6 to 12 months later. Then, after 12 to 18 months of growth, the market cools into a bear. This cycle has held up for three cycles now. The last halving was in April 2024. If history repeats, we’re still in the early phase of the next bull run - not the bear.

- Macroeconomic pressure: When the Federal Reserve raises interest rates, money flows out of risky assets like crypto. In 2022, rate hikes pushed Bitcoin down hard. Lower rates usually mean more liquidity - and that helps crypto bounce back faster.

- Regulation: The SEC’s actions, lawsuits against exchanges, or delays in approving ETFs can freeze investor confidence. But when regulators move toward clarity - like the approval of Ethereum ETFs in May 2024 - it often signals the end of the worst of the bear.

- Market sentiment: Tools like the Crypto Fear & Greed Index show when panic peaks. When the index drops below 20, it often marks the bottom. That’s when smart money starts buying.

What’s changed since 2020? Institutional money. BlackRock, Fidelity, and Grayscale now hold billions in Bitcoin. That’s not speculative retail cash - it’s long-term capital. These players don’t panic-sell. They accumulate during dips. That’s changing how long bear markets last.

How Long Does It Take to Recover?

Recovery isn’t the same as the end of the bear market. The bear ends when prices stop falling and start rising. Recovery is when you get back to your original investment value. That’s a longer journey.Bitcoin typically takes about 1,000 days - nearly three years - to fully recover from a major bear market decline. That’s because the rally after a bear market is often slow at first. In 2023, Bitcoin didn’t break $30,000 until August. It didn’t hit $40,000 until November. The real surge came in early 2024, after the halving.

For investors who bought at the bottom - say, $18,000 in early 2023 - the recovery was fast. By mid-2024, that same Bitcoin was worth $65,000. A 261% return in 14 months. But for someone who bought at $50,000 in late 2021? They’re still waiting. Recovery time depends entirely on when you entered.

What’s Different in 2025? The Rules Are Changing

The crypto market in 2025 isn’t the same as in 2018 or even 2022. Three big shifts are shortening bear markets:- Institutional buying: Institutions now hold 27% of Bitcoin’s circulating supply - up from just 8% in 2020. They don’t sell during dips. They buy. That creates a floor under prices.

- ETFs and regulated access: Spot Bitcoin ETFs launched in January 2024. They’ve brought in over $18 billion in inflows by Q3 2024. This isn’t just hype - it’s real, steady demand.

- Lower volatility: The 2024-2025 cycle saw only a 35% correction after the halving. Previous cycles saw 75-85% drops. Why? More stable capital entering the market. Less speculation. Less panic.

Analysts at JPMorgan and Standard Chartered now predict future bear markets will last only 6 to 8 months. Bloomberg’s survey of 12 major institutions found an expected average of 8.2 months - down from 9.8 months historically. The market is maturing. The wild swings are fading.

What Should You Do During a Bear Market?

If you’re holding crypto right now and the price is down, here’s what actually works:- Dollar-cost average: Buy a fixed amount every week or month. Don’t try to time the bottom. In 2022, users on Reddit who DCA’d through the bear market recovered their losses within 18 months.

- Don’t use leverage: 87% of liquidations during the 2022 bear market happened to traders using 10x or higher leverage. If you’re not a professional, don’t gamble with borrowed money.

- Keep cash ready: Hold 3 to 6 months of expenses in stablecoins or fiat. That way, when Bitcoin hits $18,000 again, you can buy without selling your car or taking a loan.

- Learn, don’t scroll: Use bear markets to study on-chain metrics like NUPL and MVRV. Watch how Bitcoin behaves when the Fed changes rates. Read reports from Coin Bureau, Kraken Research, or Binance Academy. The more you know, the less you panic.

Most retail traders quit too early. Kraken’s 2024 Behavioral Finance Report found 68% of them sell near the bottom because they can’t handle the stress. The people who win? The ones who stay calm, keep buying, and wait.

Will the Next Bear Market Be Shorter?

Almost certainly. The data says so. More institutions. More regulation. More infrastructure. Less speculation. Crypto is growing up.That doesn’t mean it won’t hurt. Bitcoin could still drop 40% in the next cycle. But it won’t take 14 months to bottom out. It’ll likely be 6 to 8. And the recovery? Faster too.

The crypto winter isn’t disappearing. But it’s getting shorter. And for those who understand the rhythm - who know when to hold, when to buy, and when to ignore the noise - that’s not a threat. It’s an opportunity.

How long do crypto bear markets usually last?

Crypto bear markets typically last between 9 and 14 months, based on historical cycles. The average is around 9.6 to 10 months, but some can be as short as 4 to 5 months or as long as 20 months. The 2021-2023 bear market lasted 14 months, while the 2017-2018 one lasted 13 months.

Is a crypto bear market worse than a stock market bear market?

Crypto bear markets are usually shorter but steeper. Bitcoin lost 75% of its value in 2022, while the S&P 500 lost about 25% in its 2022 bear market. Traditional markets take longer to recover - often 1 to 2 years - but crypto’s volatility means sharper drops and faster rebounds once sentiment turns.

Does Bitcoin’s halving affect how long bear markets last?

Yes. Historically, Bitcoin’s halving - which happens every four years - triggers a bull run 6 to 18 months later, followed by a bear market lasting 12 to 14 months. The April 2024 halving is the latest in this pattern. While the next bear market might be shorter due to institutional involvement, the halving cycle still sets the overall rhythm.

How long does it take to recover from a crypto bear market?

Recovery - meaning getting back to your original purchase price - often takes 2.5 to 3 years. Bitcoin took about 1,000 days to recover from its 2018 low. But if you bought at the bottom of the 2022 bear market, you saw a 260%+ return in just 14 months. Timing matters more than duration.

Should I sell my crypto during a bear market?

Selling during a bear market locks in your losses. Most successful investors use bear markets to buy more at lower prices. Kraken’s data shows 68% of retail traders sell too early - right at the bottom. If you believe in crypto long-term, holding or dollar-cost averaging is far more effective than selling.

Are crypto bear markets getting shorter?

Yes. Analysts from JPMorgan, Standard Chartered, and Bloomberg predict future bear markets will last only 6 to 8 months, down from the historical average of 9.8 months. This is due to institutional buying, ETFs, and less speculative trading. The market is maturing - and that means less extreme swings.

gerald buddiman

OH MY GOD, I JUST RECOVERED FROM THE 2022 CRASH AND NOW I’M WATCHING THIS AGAIN???!?! I’M SWEATING LIKE I’M IN A SAUNA WHILE MY PORTFOLIO’S ON LIFE SUPPORT!!!

Arjun Ullas

It is imperative to recognize that the historical duration of crypto bear markets, as delineated in the aforementioned analysis, is predicated upon data derived from volatile, unregulated speculative environments. The structural evolution of institutional capital inflows, regulatory clarity, and ETF-based liquidity mechanisms fundamentally alters the prior paradigm. Therefore, extrapolating historical averages into the current macroeconomic context constitutes a logical fallacy.

Steven Lam

stop acting like crypto is some kind of science experiment everyone just buys low and sells high thats it no magic cycles no halving nonsense just dumb people with money

Noah Roelofsn

The narrative that bear markets are shrinking is compelling-but let’s not romanticize it. Institutional capital doesn’t eliminate volatility, it merely camouflages it. The 35% correction post-halving? That’s not maturity-it’s a controlled bleed. Hedge funds are quietly accumulating at $18K while retail gets scared off by FUD. When the next pump hits, they’ll unload on the same people who thought this was ‘different.’ The rhythm hasn’t changed. The players just got fancier suits.

Sierra Rustami

America built this. The rest of the world is just borrowing our tech and crying when it dips.

Glen Meyer

you think institutions are here to help? they’re here to suck the life out of retail like vampires at a blood festival. they buy the dip, then they short it right after. we’re just the bait.

Christopher Evans

While the data presented is statistically coherent, one must exercise caution in interpreting temporal trends without accounting for selection bias. The inclusion of only three major cycles may not provide a robust sample for predictive modeling. Additionally, the assertion that institutional involvement shortens bear markets assumes a level of market efficiency that has yet to be empirically validated across multiple macroeconomic regimes.

Abelard Rocker

Okay so let me get this straight-Bitcoin’s halving is like a cosmic heartbeat, right? And every four years, the universe just… pauses… and whispers ‘time to get rich or get crushed’? And now we’re supposed to believe that because BlackRock bought some Bitcoin, the laws of human greed and panic have been repealed? Like, what? The same people who screamed ‘it’s 2008 all over again’ in 2022 are now saying ‘this time it’s different’ because ETFs exist? I’ve seen this movie before. The hero always gets stabbed right after the montage ends. The halving is a trigger, not a cure. And the institutions? They’re not your friends. They’re the guys who bought the whole theater and now they’re holding the popcorn while you cry in the dark.

Hope Aubrey

YOOOOO the ETF inflows are literally the new oil baby!! 💸🔥 I mean, $18B in 9 months?? That’s not capital-it’s a tidal wave of FOMO with a compliance badge. And don’t even get me started on how the SEC’s silence is the real signal. No lawsuit = green light. They’re not stopping it anymore-they’re directing it. This isn’t a bear market anymore, it’s a slow-mo bull train with a safety harness. I’m buying more ETH on every dip. #DeFiIsHere

andrew seeby

bro i just dca’d $50 every friday since jan and now im up 200% 😎🙌 i didnt even check my portfolio for 6 months, just kept adding. crypto is like weed, you dont time it, you just keep smoking 😅

Pranjali Dattatraya Upadhye

Wow, this is such a thoughtful breakdown! I love how you tied in the halving cycle with institutional behavior-it really helps me see the bigger picture. I’ve been holding since 2021 and honestly, reading this made me feel so much calmer. I think I’ll start tracking NUPL next week, just like you suggested. Thank you for writing this with so much care ❤️

Kyung-Ran Koh

One of the most balanced, well-researched takes I’ve read in months. The distinction between ‘bear market end’ and ‘recovery’ is critical-and often overlooked. Dollar-cost averaging isn’t sexy, but it’s the only strategy that survives repeated cycles. Also, thank you for mentioning Kraken’s behavioral report. Too many people blame the market when the real issue is emotional discipline. Keep sharing insights like this. 🙌

Missy Simpson

i just bought more btc at 61k 😭 i know i should wait but i cant help it!! this feels like the moment!! 🚀💖

Tara R

Interesting. The author clearly has a vested interest in maintaining retail participation. The data cherry-picked ignores the fact that institutional accumulation is merely a longer-term manipulation tactic. The halving cycle is a myth propagated by crypto influencers to sell newsletters. The market is a casino. You are the house. They are the players. And you’re being told to keep betting.

Matthew Gonzalez

What if the bear market isn’t a phase to endure-but a mirror? It shows us who we are when the noise fades. The ones who sell are afraid of scarcity. The ones who buy are afraid of missing out. Both are trapped in the same story. The market doesn’t care. It just reflects. Maybe the real question isn’t how long it lasts… but what it reveals about us.

Michelle Stockman

9.6 months? Cute. You’re still a retail sheep if you believe that. The real bottom? When the CEO of Coinbase starts posting memes about ‘dying with dignity.’ Then you know it’s time to sell your last BTC and buy gold.

Eric von Stackelberg

Did you know the Federal Reserve secretly controls Bitcoin’s blockchain through a backdoor in the SHA-256 algorithm? The halving is a distraction. The real reset happens when the Fed injects liquidity into mining pools via offshore shell companies. This entire article is a psyop to keep you buying while they prepare for the digital currency transition. You’re being played.

Emily Unter King

On-chain metrics like NUPL and MVRV are indispensable for macro-level sentiment analysis. The current MVRV ratio of 0.87 indicates deep undervaluation relative to historical norms. Combined with ETF inflows and a declining hash rate sell-off, this suggests a structural accumulation phase is underway-not a bear market continuation. The 6-8 month projection is conservative.

Michelle Sedita

I think the real lesson here isn’t about timing the market-it’s about learning to sit with discomfort. Most people can’t handle the silence between the highs. But the quiet periods? That’s where wisdom grows. Not in the charts. In the stillness.

John Doe

they’re all lying. the halving is fake. btc is controlled by a secret cabal of central bankers and chinese tech giants. they pump it to steal your seed phrase. i checked the blockchain-there’s a hidden backdoor in block 840000. they’re using your wallet to mine quantum crypto. i saw it in a dream. i’m not crazy. i have screenshots. 👁️