Crypto bear markets typically last 9 to 14 months, with the 2021-2023 slump lasting 14 months. Historical patterns show recovery takes years, but institutional involvement is shortening cycles. Learn what drives bear markets and how to survive them.

Crypto Winter Length: How Long Do Bear Markets Really Last?

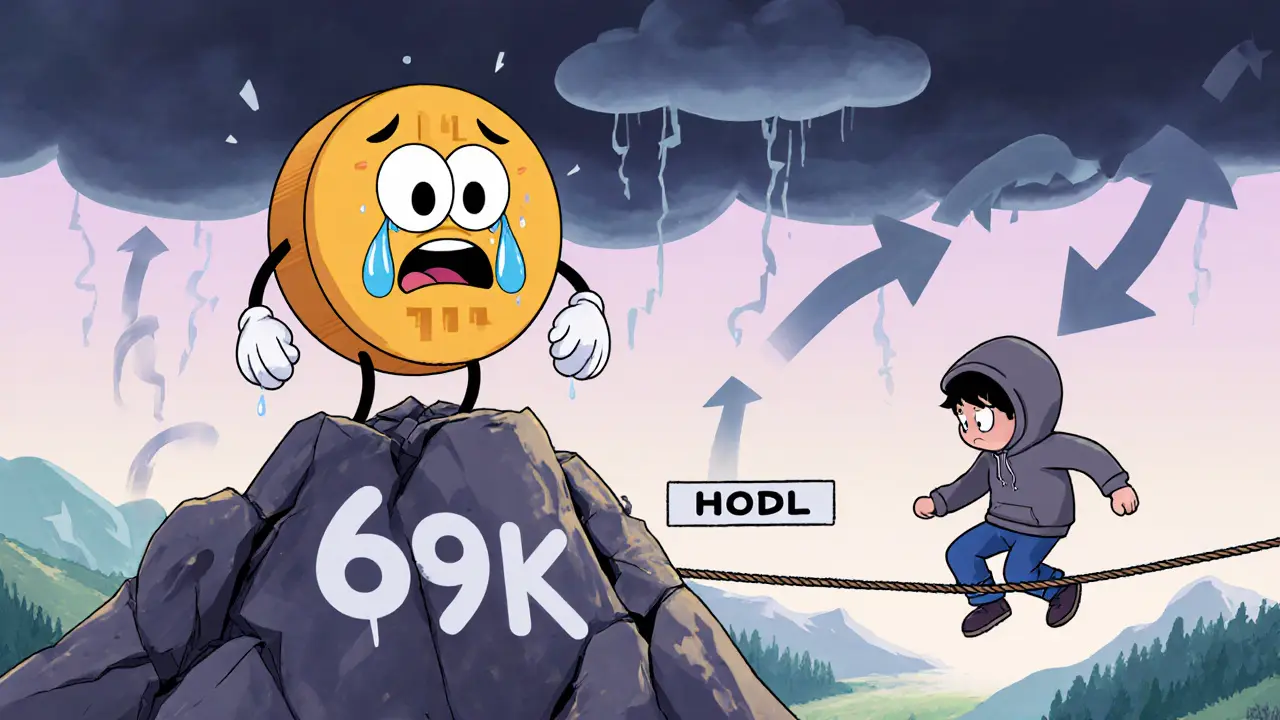

When the market drops and everyone stops talking about moonshots, you’re in a crypto winter, a prolonged period of declining prices, low trading volume, and reduced investor enthusiasm in the cryptocurrency market. Also known as a crypto bear market, it’s not a glitch—it’s part of the cycle. Bitcoin and altcoins don’t just go up forever. They rise, peak, crash, and then sit quiet for months—or years—before the next rally. The question isn’t if it’ll happen, but how long it’ll last this time.

History shows crypto winter length usually runs between 12 and 36 months. The 2018 bear market lasted about 14 months. The 2022 crash dragged on for nearly two years. What’s the pattern? It’s not random. It’s tied to macro trends like interest rates, regulatory pressure, and how long it takes for new projects to build real users. When Bitcoin halvings happen, they often kick off the next bull run—but not until the market has fully digested the previous hype. That digestion phase? That’s the winter.

It’s not just about price. During a crypto winter, blockchain development, the actual building of protocols, smart contracts, and infrastructure keeps going. Teams that survive the downturn are the ones who focused on tech, not TikTok trends. You’ll see real work: better wallets, more secure exchanges, energy-efficient consensus models. That’s why some of the strongest projects today—like SunContract and EquityPay—were built in the cold. They didn’t chase airdrops. They solved real problems.

And don’t forget crypto market cycle, the repeating pattern of boom, bust, and recovery that defines digital asset markets. It’s not just Bitcoin. Ethereum, Solana, even niche tokens like Macho or TRIP all ride the same tide. When the winter hits, most airdrops dry up. Exchanges like CoinDeal or Armoney lose volume. But the ones that stay transparent, keep fees low, and don’t promise fake rewards? They’re the ones you want to watch. Because when spring comes, they’re ready.

What you’ll find in these posts isn’t guesswork. It’s real data from past winters, breakdowns of how miners and validators keep the network alive when fees drop, and guides on spotting fake airdrops when everyone’s desperate for free tokens. You’ll see how Afghanistan’s underground crypto scene survived a total ban, how the UAE stayed tax-free while others cracked down, and why a stablecoin like DDM is a red flag—not a safe haven. This isn’t about timing the bottom. It’s about staying sharp when the noise fades. The next bull run won’t be won by those who bought at the peak. It’ll be won by those who stayed awake during the winter.