Crypto bear markets typically last 9 to 14 months, with the 2021-2023 slump lasting 14 months. Historical patterns show recovery takes years, but institutional involvement is shortening cycles. Learn what drives bear markets and how to survive them.

Crypto Market Cycle: Understand the Phases, Triggers, and How to Profit

When you hear people talk about the crypto market cycle, a recurring pattern of price surges and crashes driven by supply shocks, investor psychology, and network development. It’s not random noise—it’s a rhythm shaped by code, incentives, and human behavior. This cycle repeats roughly every four years, and if you know where you are in it, you can make better decisions than 90% of traders.

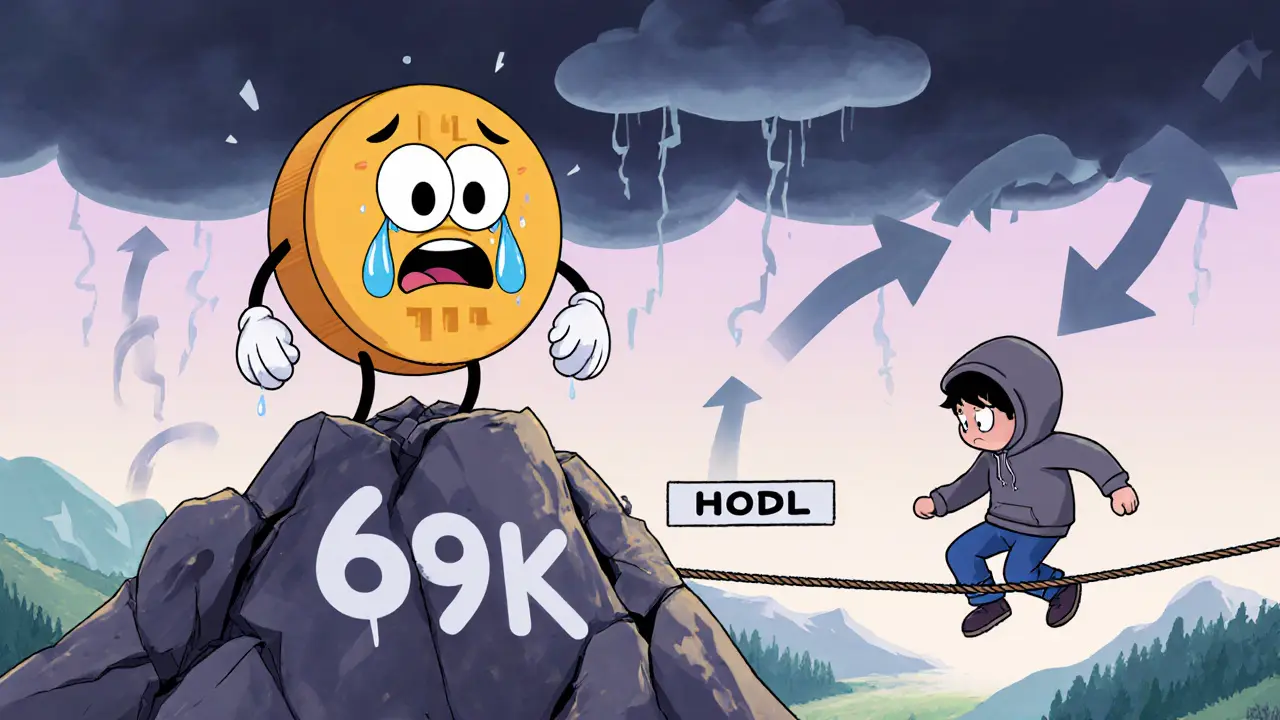

The Bitcoin halving, a scheduled event that cuts new Bitcoin supply in half every 210,000 blocks. It’s the engine behind most crypto bull runs. When miners get fewer rewards, selling pressure drops—and if demand stays steady or grows, prices climb. The last halving in 2024 triggered a new cycle, just like 2020 and 2016 did before it. But the cycle isn’t just about Bitcoin. bull market, a phase where investor confidence, media hype, and new money flood into crypto, pushing altcoins far beyond Bitcoin’s gains. Then comes the bear market, a period of low sentiment, wallet draining, and project failures, where only the strongest survive. These phases aren’t just price swings—they’re survival tests for entire ecosystems.

On-chain data tells you where you are. Are wallets accumulating? Is exchange outflow rising? Are new addresses growing? These signals matter more than tweets. The last cycle showed how DeFi tokens exploded in the early bull phase, while meme coins peaked late—right before the crash. Airdrops like WINGS, FOC, and LNR often drop during bear markets to build communities, while real projects like SunContract and EquityPay quietly improve their tech. Meanwhile, exchanges like Aboard and Karura Swap get tested under pressure. Regulatory moves in the UAE, Russia, and India also shift the cycle’s timing—crypto doesn’t move in a vacuum.

Knowing the cycle doesn’t guarantee profit, but it removes guesswork. If you’re buying during a bear market when fear is high, you’re playing the long game. If you’re selling near the top of a bull run when everyone’s talking about 100x gains, you’re protecting your capital. The posts below break down exactly how these phases play out—what tokens rise when, which exchanges survive downturns, how airdrops fit into the rhythm, and what to watch for next. No fluff. Just what’s real, what’s risky, and what actually moves the needle.