Crypto bear markets typically last 9 to 14 months, with the 2021-2023 slump lasting 14 months. Historical patterns show recovery takes years, but institutional involvement is shortening cycles. Learn what drives bear markets and how to survive them.

Crypto Bear Market Duration: How Long Do They Last and What Happens Next?

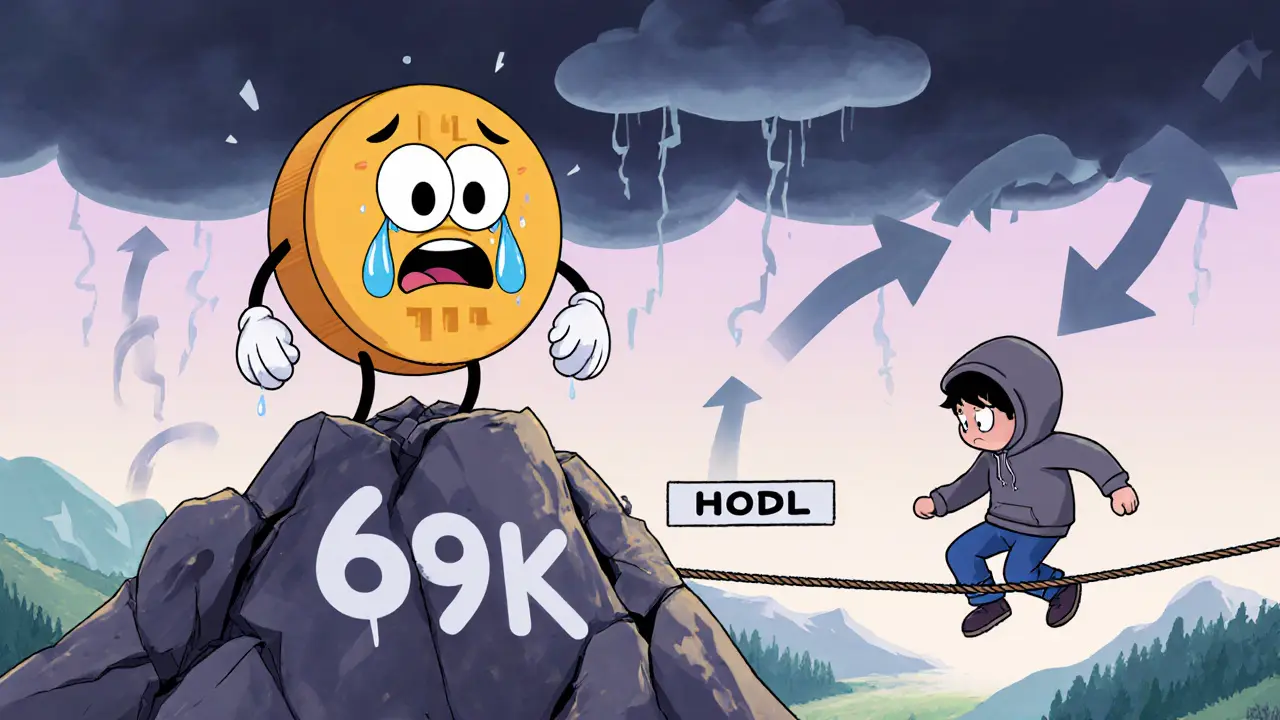

When the crypto bear market, a prolonged period of falling prices and low investor confidence in cryptocurrency markets. Also known as a crypto downturn, it’s when most coins lose value for months—or sometimes years—regardless of news or hype. It’s not just about prices dropping. It’s about fear taking over, trading volume drying up, and projects struggling to survive. The Bitcoin bear market, the most closely watched indicator of overall crypto sentiment often sets the tone, but altcoins usually fall harder and take longer to recover. What you need to know isn’t just how long it lasts—it’s how to recognize the patterns so you don’t panic-sell or chase dead ends.

Historically, crypto bear markets last anywhere from 12 to 36 months. The 2018 bear market after the 2017 ICO boom ran for about 14 months before Bitcoin started climbing again. The 2022 crash, triggered by FTX’s collapse and rising interest rates, lasted nearly two years. That’s longer than most people expected, but it lines up with past cycles. The crypto market cycles, repeating patterns of boom and bust driven by investor psychology, regulatory shifts, and technological milestones don’t follow a calendar—they follow behavior. When new money stops flowing in and early buyers start cashing out, the market turns. And when real projects start building instead of just marketing, the bottom is near.

What separates a bear market from a total collapse? It’s the projects that survive. In 2022, tokens like SunContract and EquityPay kept going because they had real use cases—not just whitepapers. Wallets like Ledger and exchanges like Aboard Exchange didn’t vanish because they solved actual problems. The crypto recovery time, the period it takes for major assets to regain previous highs after a downturn depends on who’s still active. If developers are still coding, users are still transacting, and incentives like block rewards and staking rewards keep networks secure, then the market will heal. It’s not about when the news turns positive—it’s about when the code keeps running.

What you’ll find below isn’t a list of get-rich-quick schemes. It’s a collection of real, no-fluff guides on what actually matters during a bear market: how to spot fake airdrops, how exchanges survive when volume drops, how stablecoins like DDM fail or hold up, and how to protect your assets when everyone’s scared. These aren’t predictions. They’re observations from people who lived through it—and kept going.