Crypto bear markets typically last 9 to 14 months, with the 2021-2023 slump lasting 14 months. Historical patterns show recovery takes years, but institutional involvement is shortening cycles. Learn what drives bear markets and how to survive them.

Bitcoin bear market: What It Is, How It Hits, and What Comes Next

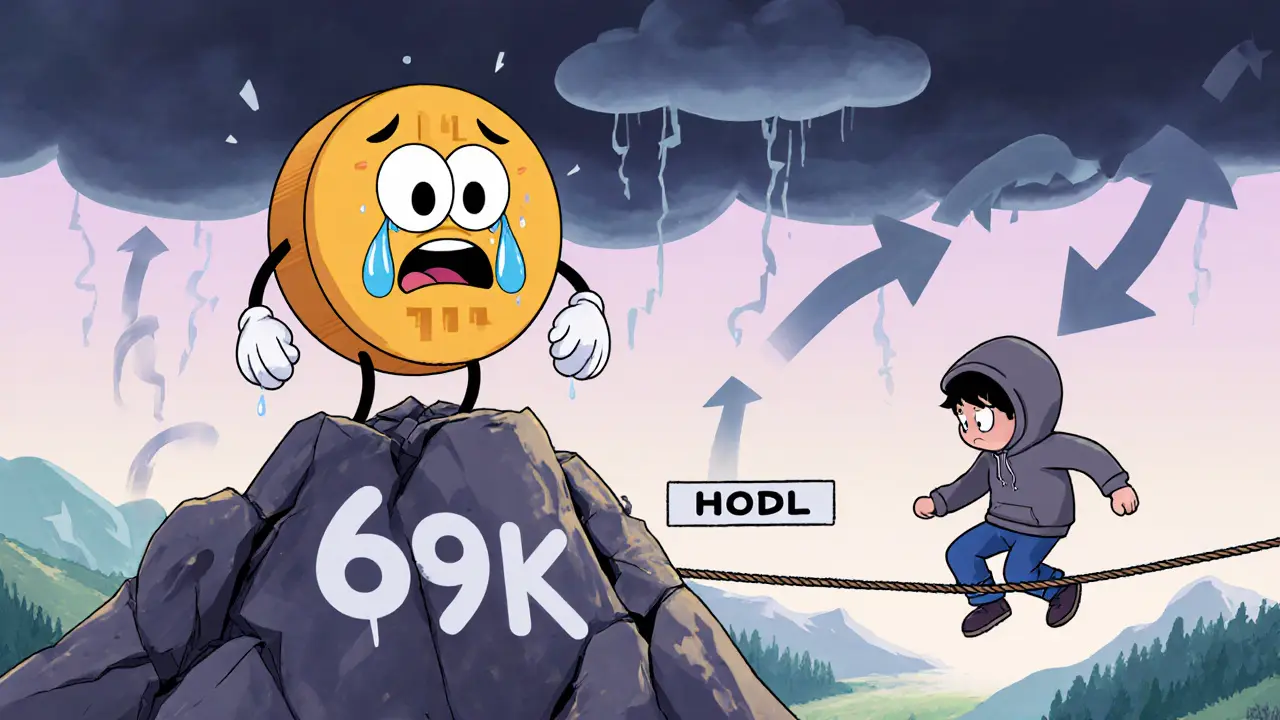

When we talk about a Bitcoin bear market, a prolonged period where Bitcoin prices fall consistently due to widespread selling pressure and low investor confidence. Also known as a crypto downturn, it’s not just about the chart going down—it’s about how people think, act, and survive when the hype fades. Unlike a short-term dip, a bear market lasts months or even years. It’s when holders stop chasing gains and start protecting what they have. Miners cut costs. Exchanges see less volume. Airdrops dry up. And the only people still building are the ones who believe in Bitcoin long after the crowd leaves.

A Bitcoin halving, the event where miner rewards are cut in half roughly every four years. Also known as Bitcoin supply shock, it’s a core driver of these cycles. After each halving, supply growth slows. But the market doesn’t react instantly—it takes time for demand to catch up. That’s why bear markets often follow halvings. The 2020 halving led to a 2022 crash. The 2024 halving? We’re still in the aftermath. Meanwhile, transaction fees, the payments users send to get their Bitcoin transactions confirmed. Also known as network fees, they become more important when block rewards shrink. Miners rely on them more than ever, and users start watching every satoshi they spend. This shift changes how people use Bitcoin. It’s no longer just a speculative asset—it becomes a settlement layer, a store of value, and sometimes, just a backup plan.

What you’ll find in these posts isn’t guesswork or fearmongering. It’s real examples of how people navigate these times. You’ll see how block reward, the Bitcoin coins miners earn for adding new blocks to the chain. Also known as mining subsidy, it’s the fuel that keeps the network alive—and why its reduction forces hard choices. You’ll learn why fake airdrops like TokenBot or VDR pop up during bear markets, preying on desperation. You’ll see how stablecoins like Deutsche Mark (DDM) or asset-backed tokens like Five Pillars Token (5PT) get traction when Bitcoin is down. And you’ll understand why exchanges like CoinDeal or Armoney struggle when traders vanish. This isn’t about timing the bottom. It’s about surviving the grind, spotting real signals, and knowing when to hold, when to move, and when to walk away.

There’s no magic formula to escape a Bitcoin bear market. But there are patterns. And in the posts below, you’ll find the facts—no fluff, no hype—just what’s actually happening on-chain, in wallets, and in the minds of those still in the game.