Network Effect Value Calculator

Metcalfe's Law states that the value of a network is proportional to the square of its users (N²). This calculator demonstrates how network value grows exponentially as user count increases.

As explained in the article, Bitcoin's value isn't just linearly higher than smaller networks—it's exponentially stronger due to network effects.

Using Metcalfe's Law: Value = N²

For 0 users, the theoretical network value is 0 units.

Theoretical value: ~190,000,000,000,000 units (N²)

Theoretical value: ~625,000,000,000 units (N²)

Theoretical value: 10,000,000,000,000 units

This model shows why network effects create exponential value growth. As the article explains, Bitcoin's massive user base gives it a theoretical value roughly 20x higher than a network with 100 million users, not just linearly higher.

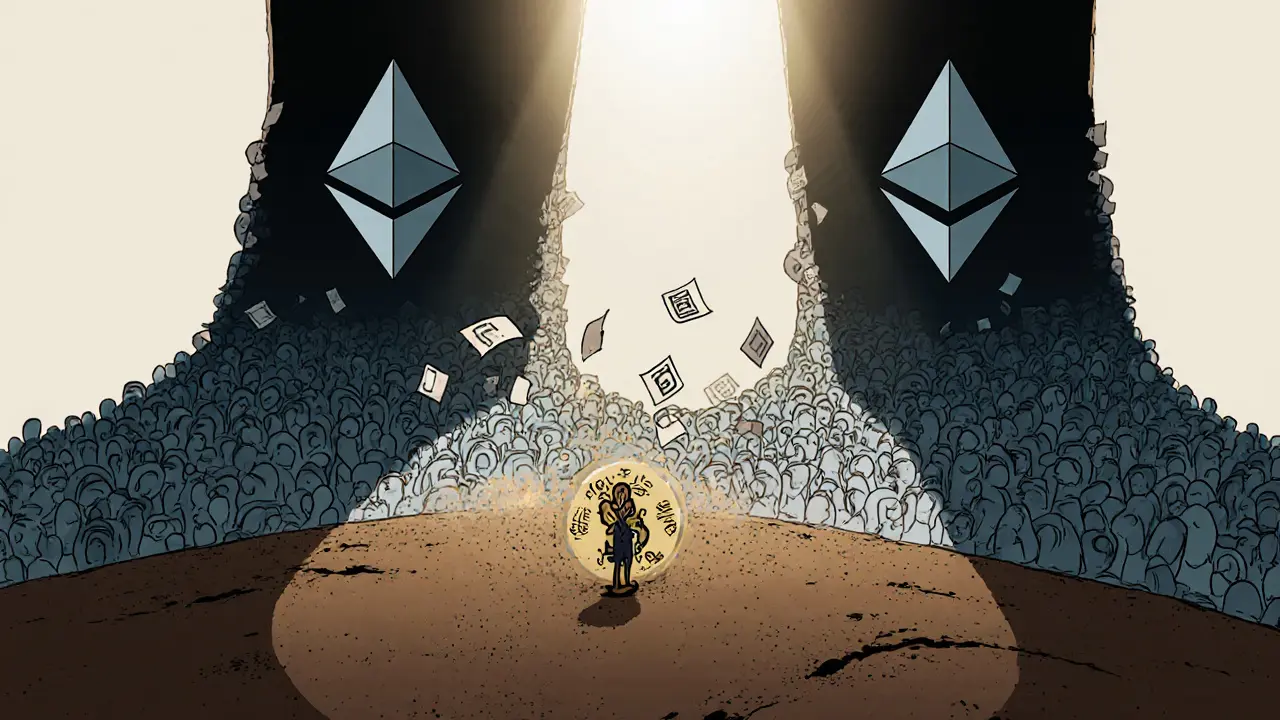

When you buy Bitcoin, you’re not just buying code. You’re buying into a network of millions of people who use it, trust it, and keep it secure. That’s the real engine behind its value. The same goes for Ethereum, Solana, or any major crypto project. The price doesn’t rise because someone says it’s ‘innovative’-it rises because network effects make it more useful, more liquid, and harder to replace as more people join.

What Network Effects Actually Mean in Crypto

Network effects aren’t just a buzzword. They’re a mathematical reality. When a network grows, its value doesn’t just go up linearly-it goes up exponentially. This idea, called Metcalfe’s Law, says the value of a network is proportional to the square of its users (N²). So if a crypto network has 100 users, its value is roughly 10,000 units. If it hits 1,000 users? That’s 1 million units of value. That’s why Bitcoin, with over 435 million users as of late 2023, isn’t just 4 times more valuable than a network with 100 million users-it’s potentially 20 times more valuable in real terms.This isn’t theory. It’s what you see every day. More users mean more transactions, which means more fees for miners and stakers, which means more security. More security attracts institutions. More institutions bring more liquidity. More liquidity makes it easier to buy and sell without crashing the price. And that’s what keeps people coming back.

Bitcoin: The Network That Grows on Its Own

Bitcoin’s network effect is the strongest in crypto-not because of fancy tech, but because of its simplicity and resilience. Every 2,016 blocks (about every two weeks), Bitcoin automatically adjusts how hard it is to mine new coins. This keeps block times steady at 10 minutes, no matter how many miners join or leave. That consistency builds trust.Then there’s the halving. Every 210,000 blocks-roughly every four years-the reward for mining Bitcoin cuts in half. This creates a predictable, shrinking supply. Historically, each halving has been followed by a price surge, not because of hype, but because demand keeps growing while supply tightens. That’s network effect in action: more users → more demand → higher price → more attention → even more users.

And it’s not just individuals holding Bitcoin. Over 40% of Fortune 500 companies are now exploring blockchain, and many choose Bitcoin as their primary crypto exposure. Why? Because it’s the most battle-tested network. It’s survived crashes, bans, and skepticism for over 15 years. That’s not luck. That’s a network so strong, it becomes the default.

Ethereum: The Developer Network That Feeds Itself

Ethereum’s network effect works differently. Instead of being a store of value like Bitcoin, it’s a platform. Every time a developer builds a new dApp-whether it’s a decentralized exchange, a lending protocol, or a gaming token-they add value to the network. More dApps attract more users. More users generate more transaction fees. More fees mean more rewards for validators. More rewards attract more validators. More validators make the network more secure.As of Q2 2023, Ethereum hosted over 4,000 active dApps. That’s not a number you can copy. You can fork the code-Ethereum Classic did-but you can’t copy the community, the developer talent, or the liquidity. Ethereum Classic has less than 0.5% of Ethereum’s market cap, even though it started with the exact same code. Why? Because network effects aren’t about code. They’re about people.

The Ethereum Merge in September 2022 was a turning point. It cut energy use by 99.95%. That wasn’t just greenwashing-it was a network upgrade that made Ethereum more sustainable, more attractive to institutions, and more scalable. Post-Merge, staking participation jumped 45%. That’s the network effect working in real time: better tech → more participation → more value.

When Network Effects Go Wrong

Network effects aren’t always good. Sometimes, too many users break the system.In 2021, during the NFT boom, Ethereum’s network got clogged. Gas fees spiked from $1.50 in January to over $65 in August. Some users paid $200 in fees to buy an NFT worth $150. That’s not a feature-it’s a bug. And when that happens, people leave. They switch to alternatives. That’s a negative network effect: growth that backfires.

That’s why Layer 2 solutions like Arbitrum, Optimism, and zkSync exploded in popularity. They handle transactions off the main chain, then settle them back on Ethereum. By October 2023, Layer 2s were processing 68% of all Ethereum transaction volume. That’s not a replacement-it’s an enhancement. The main network stays secure and valuable, while the scaling layers handle the traffic. That’s how you fix negative network effects without breaking the core.

How to Spot Real Network Growth vs. Hype

Not every coin with a rising price has real network effects. Some are just pump-and-dumps fueled by incentives.Here’s how to tell the difference:

- Active addresses: Bitcoin averaged 1.1 million daily active addresses in Q3 2023. That’s organic usage-not bots or airdrop hunters.

- Developer activity: Ethereum had over 2,300 active monthly developers in 2023. That’s a living ecosystem, not a one-time launch.

- Transaction volume: Ethereum processed $1.2 trillion in quarterly volume in Q2 2023. That’s real economic activity.

- Revenue-to-valuation ratio: If a project’s market cap is 100x its revenue, it’s likely speculative. If it’s under 10x, it’s probably sustainable.

Look at DeFi Summer 2021. Total Value Locked (TVL) grew 3,000% in months. But most of those projects vanished within a year. Why? They didn’t have real users-they had incentivized users. When the rewards stopped, so did the activity. Real network effects last because people use the product for its utility, not its token.

Why Most New Cryptocurrencies Fail

You see new coins every week. Solana had its moment. Avalanche, Polygon, BSC-all had big launches. But only Bitcoin and Ethereum dominate. Why?Because network effects are cumulative. The longer a network has been around, the more users, developers, and infrastructure it has. New chains start from zero. Even if they’re faster or cheaper, they can’t compete with the inertia of a network that’s been growing for 15 years.

Think of it like social media. You could build a better version of Facebook. But no one’s going to join if all their friends are on Facebook. Same with crypto. Why switch from Ethereum to a new chain if all the dApps, wallets, and liquidity are already on Ethereum?

The result? A power law distribution. As of October 2023, Bitcoin and Ethereum made up 70% of the entire crypto market cap. The next 10 coins combined? Just 20%. The rest? Barely 10%. That’s not a coincidence. That’s network effects at work.

What Comes Next: Layer 2s, Regulation, and the Next Phase

The future of crypto valuation isn’t about new chains. It’s about scaling the existing ones. The Lightning Network for Bitcoin is now processing $150 million daily-up from $1 million in 2021. That’s not replacing Bitcoin. It’s making it more usable for everyday payments.Regulation is the wild card. When the SEC cracked down on Ripple, it didn’t kill XRP’s network-it fragmented it. Some exchanges delisted it. Liquidity dropped. That’s how regulation can weaken network effects: by cutting off access.

But the trend is clear. Galaxy Digital predicts that by 2030, the top three blockchains will hold 85% of all crypto value. That’s not because they’re the flashiest. It’s because they’ve built the strongest networks.

Network effects in crypto aren’t optional. They’re the only real fundamental that matters. No earnings? Doesn’t matter. No physical assets? Irrelevant. What matters is: How many people are using it? How many developers are building on it? How hard would it be to replace?

If the answer is ‘not very,’ then it’s not a good investment. If the answer is ‘almost impossible,’ then you’re looking at the next decade’s winners.

What is Metcalfe's Law and how does it apply to Bitcoin?

Metcalfe's Law states that the value of a network grows proportionally to the square of the number of users (N²). For Bitcoin, this means that as more people hold, send, or accept BTC, the network becomes exponentially more valuable-not just because there are more transactions, but because liquidity, security, and trust compound. With over 435 million users as of 2023, Bitcoin’s network value isn’t just linearly higher than a coin with 100 million users-it’s potentially orders of magnitude stronger, making it far harder to compete with.

Why doesn’t Ethereum Classic have the same value as Ethereum, even though it’s a fork?

Ethereum Classic shares the same code as Ethereum at the time of the fork, but it lacks the network effect. Ethereum has millions of users, thousands of developers, and over 4,000 active dApps. Ethereum Classic has almost none of that. Network effects aren’t about code-they’re about community, usage, and inertia. You can copy the software, but you can’t copy the ecosystem that’s grown around it over years.

Can high gas fees hurt a crypto network’s value?

Yes, absolutely. High gas fees create negative network effects. When Ethereum’s fees spiked to $65+ during the 2021 NFT boom, many users abandoned transactions or switched to alternatives. If using a network becomes more expensive than the asset you’re transacting, people leave. That’s why Layer 2 solutions like Arbitrum and zkSync became essential-they reduced fees while preserving Ethereum’s security and liquidity.

How do I know if a crypto project has real network effects or just hype?

Look at three things: daily active addresses (not just token holders), monthly active developers (not just marketing teams), and organic transaction volume (not incentivized DeFi yields). Bitcoin averages 1.1 million daily active addresses. Ethereum has over 2,300 developers per month. If a project’s growth is driven by token rewards, not real usage, it’s likely temporary. Real network effects sustain themselves without constant incentives.

Will new blockchains ever overtake Bitcoin or Ethereum?

It’s extremely unlikely. Bitcoin and Ethereum have 15+ years of network growth, institutional adoption, and developer momentum. New chains may win in niche areas, but they can’t replicate the sheer scale of trust and usage that already exists. The top three blockchains are projected to hold 85% of crypto value by 2030. The rest will compete for scraps. Network effects create winner-takes-most dynamics-and crypto is no exception.

Louise Watson

Network effects aren’t magic. They’re just people. More people → more trust → more use. That’s it.

Liam Workman

It’s wild how crypto turns math into money 💡. Metcalfe’s Law isn’t just for nerds-it’s why your $100 in BTC feels like $200 when your cousin buys in too. The network’s the real MVP. 🌐

Benjamin Jackson

I’ve been holding since 2017. Saw the hype, saw the crashes. But every time I thought it was over, more people showed up. Not because of ads. Not because of influencers. Just because it worked. That’s the quiet power of network effects.

Leo Lanham

Bitcoin’s not valuable. It’s just the last man standing. Everyone else got wrecked. That’s not a network effect-that’s survivorship bias. Wake up.

Brian Webb

Love how this breaks it down. I used to think crypto was just gambling. Then I saw how devs keep building on Ethereum even when fees are insane. They’re not chasing pumps-they’re building homes. And homes don’t get abandoned just because the rent went up.

Whitney Fleras

Layer 2s are the unsung heroes here. They didn’t try to replace Ethereum-they fixed its pain points. That’s how you grow a network without breaking it.

Colin Byrne

This entire post is a textbook example of crypto propaganda. Metcalfe’s Law is not a law. It’s a metaphor. And Bitcoin’s value is entirely based on collective delusion. The fact that people believe in it doesn’t make it real. It makes it a cult.

Arjun Ullas

As a technologist from India, I have witnessed the transformation of blockchain from academic curiosity to global infrastructure. The network effects observed in Bitcoin and Ethereum are not merely statistical-they are sociotechnical phenomena. The convergence of decentralized consensus, economic incentives, and global participation has created an irreversible momentum. No new chain can replicate this without first replicating the human ecosystem.

Steven Lam

Who cares about network effects when the FED prints money like it’s confetti? Crypto’s just inflation hedge with extra steps. Stop overcomplicating it

Noah Roelofsn

One critical oversight in this analysis: network effects require interoperability. Bitcoin’s strength lies in its simplicity, but its scalability limitations are structural. Ethereum’s ecosystem thrives because it enables composability-dApps can build on each other. That’s not just network growth; it’s exponential system synergy. Layer 2s aren’t patches-they’re evolutionary leaps.

Sierra Rustami

USA built the internet. USA will own crypto. Everything else is just noise.

Glen Meyer

They’re all gonna crash. Mark my words. This is just the last party before the cops show up. Everyone’s drunk on fake money and memes.

Christopher Evans

The empirical evidence supporting network effects in decentralized systems is robust. Historical price trajectories correlate strongly with active address growth, not speculative news cycles. Furthermore, the resilience of Bitcoin through multiple regulatory and technological stress tests confirms the durability of its network. Dismissing it as hype ignores quantifiable data.

Ryan McCarthy

Think of crypto like a town. Bitcoin’s the old general store that’s been there 15 years-everyone knows where it is. Ethereum’s the bustling downtown with new shops opening every week. You don’t need to build a whole new town. Just make the streets wider. That’s what Layer 2s are doing. And honestly? It’s working.

Abelard Rocker

Everyone’s acting like Bitcoin and Ethereum are untouchable. But what if the next big thing isn’t blockchain? What if quantum computing breaks SHA-256? What if governments just ban it outright? What if the whole thing is just a giant pyramid scheme disguised as innovation? You think the network’s strong? Wait till the lights go out. Then see how many people still believe.

Hope Aubrey

Y’all keep talking about network effects like they’re some divine law. But let’s be real-most of these ‘users’ are just bots running on AWS. And the devs? Half of them are ex-traders who got bored. This isn’t a movement. It’s a casino with better UI.

andrew seeby

layer 2s are the real win here 🤓 honestly didn’t think they’d work this well but now 68% of eth txns are on them? mind blown. crypto’s like a plant-grows roots first, then branches. we’re just seeing the branches now 🌱

Pranjali Dattatraya Upadhye

As someone from India, I’ve seen how crypto helped small businesses bypass banking red tape-remittances, microloans, even local market payments. It’s not about speculation. It’s about access. Network effects here mean real people getting financial dignity. That’s the true value.

Eric von Stackelberg

Who controls the nodes? Who owns the mining pools? Who really holds the keys? This whole ‘decentralized’ narrative is a distraction. The real power lies with a handful of Chinese mining conglomerates and Wall Street ETFs. The network isn’t strong-it’s manipulated.

Emily Unter King

Metcalfe’s Law is foundational, but it’s incomplete. The true metric is not just users, but *active, non-incentivized* participants. Bitcoin’s 1.1M daily active addresses are the real signal. Everything else-TVL, market cap, tweets-is noise. The signal is in the on-chain behavior.

Michelle Sedita

It’s funny how people treat crypto like it’s new. But network effects have always existed-think of the telephone, the fax machine, even the railroad. The first adopters suffered. The last ones got rich. History doesn’t repeat-it rhymes.

John Doe

They’re lying. The whole thing is a Fed-backed surveillance tool. Every wallet is tracked. Every transaction is logged. They want you to think it’s free-but it’s just a different kind of cage. Wake up. They’re using you to build the next totalitarian financial system.